Need another fast purchase loan or refinance? Getting turned down elsewhere for a loan?

Need another fast purchase loan or refinance? Getting turned down elsewhere for a loan?

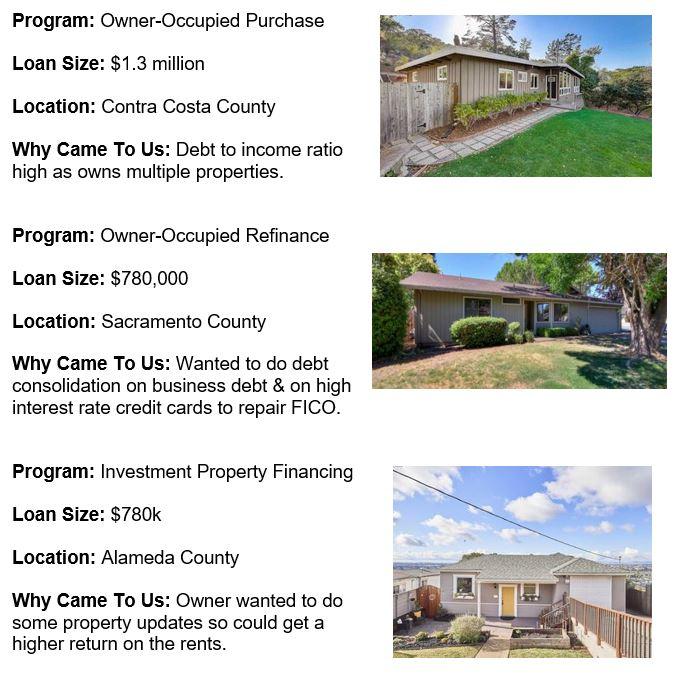

The Guys in the White Hats will wrangle in stubborn financing, solving with our Private Money Programs. With funding options up to 2 million, after 34 years we still have not run out of money and are ready to quickly finance you or someone you know, just like we did for the Borrowers below:

Recently Funded

It’s not our first rodeo! At Sun Pacific Mortgage, we help Borrowers in California finance their real estate needs if they want fast loans or were turned down elsewhere. Call Us at 707-523-2099 or visit our website at www.sunpacificmortgage.com with your scenario to see how we can help you or someone you know, wrangle in that loan!