Businesses headquartered in other counties or states have recently come to Solano County ushering in an uptick of population growth for the cities of Benecia, Vallejo, Dixon, Vacaville, Fairfield, and Suisun City according to a recent article in the North Bay Business Journal.

With the effects of the pandemic shutdown being felt everywhere, these cities have tried to keep above water by relaxing impact fees to maintain and foster growth.

In Vallejo, local government has reduced red tape and updated parking requirements and the zoning code. Recent additions to the business world have included a management firm responsible for long-term planning and Tesla.

Two new additions to support employees in Dixon are the arrival of a GE Appliance distribution center and TEC Equipment of Portland, Oregon. Both companies will add to the employment opportunities available to Solano County residents. Significant funding from the California Department of Housing and Community Development have assisted Dixon businesses impacted by the pandemic.

Vacaville continues to attract biomanufacturing companies which is aiding in the economic growth of the area. The city is fast-tracking programs for business entitlement approvals. New hotels and eateries are springing up to support the influx of business. Of special note, is the announcement that Agenus Inc. is ready to build a research and develop site to advance their study and production of oncology-related therapies. It is believed that Vacaville’s affordable housing in comparison to other markets made the choice a logical one. Local officials predict that the region could attract 10,000 people from all over the world to fill these biotech jobs in the next few decades.

Equidistance between San Francisco and Sacramento, Fairfield is an appealing location for a transportation hub for Northern California with a rail terminal downtown. With its affordable housing prices, Fairfield is attracting businesses and homebuyers. To aid in the acceleration process of homebuilding, the city has instituted a new tool that prequalifies architectural submittals.

From this report we can conclude that business is booming in Solano County and for the present, housing is more affordable than in other parts of the North Bay. Its location makes it easily accessible to The City and recreational areas making it a very desirable choice right now.

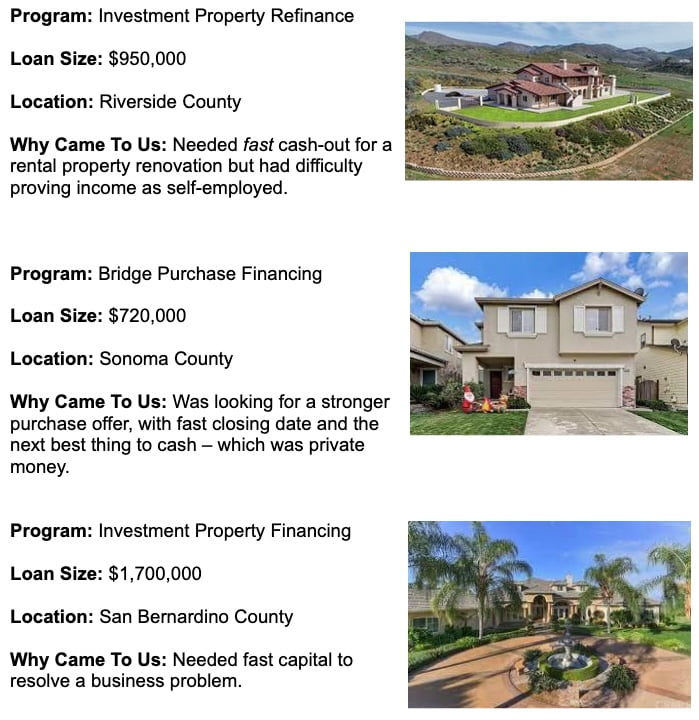

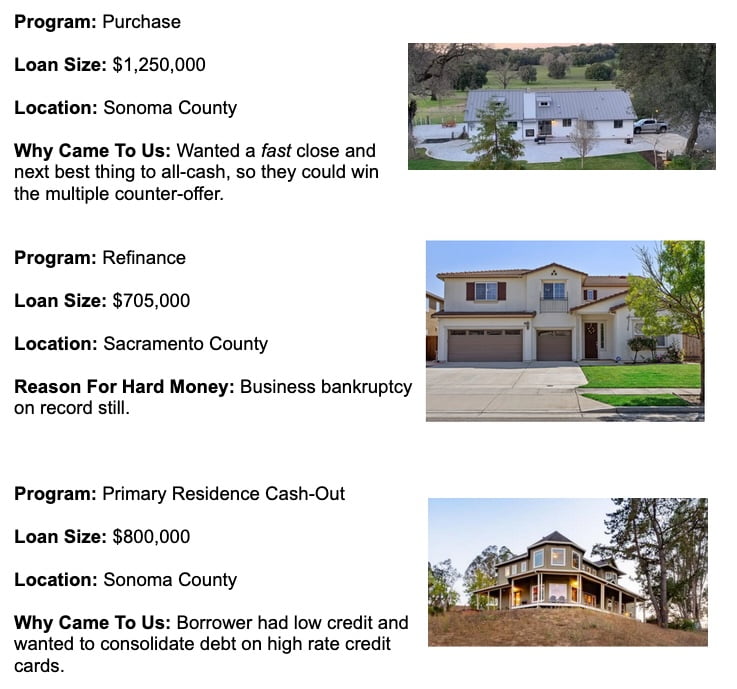

If you think a move or investment in this growing community is right for you, but you are not able to qualify for a conventional loan, give Sun Pacific Mortgage a call at 707-523-2099 or visit our website at www.sunpacificmortgage.com. We have helped thousands of folks just like you over the past 33 years we have been business. Short-term and long-term fast private funding is available so that you can begin profiting from the remarkable growth being experienced in Solano County.