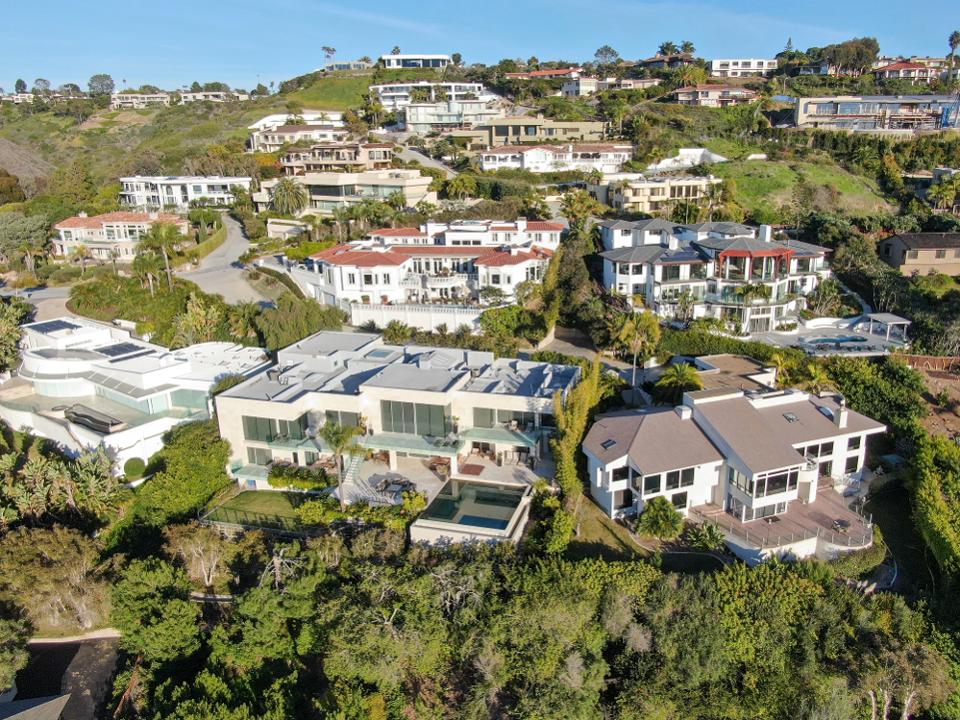

The California real estate market got a boost recently, when it was reclassified as an “essential” industry. Since March 20th face-to-face real estate sales have been non-existent. As a result, and coupled with the economic anxieties, local house hunters in Sonoma County, Santa Clara, San Mateo, and San Francisco Counties (as well as the rest of California) have been hesitant to pursue any real estate deals. But as of May 4, the new ruling allows occupied homes can be shown as long as the seller is not present.

This certainly does not mean “business-as-usual”, but homes may be shown following local and state regulations. In general, that means only 2 buyers + their 1 agent may be present (no kids, no friends, no parents) and the 2 buyers must already live in the same household. Many “virtual open houses” are popping up as well, to provide more options to interested Home Buyers.

It is the opinion of most real estate agents that May will be transitional and June more normal.

But what about after the “shelter-in-place” order? What will the market look like then? Once we are through this period, which appears may be June 1st or so, there will be some challenges that linger for a while but this is where creativity comes into play from talented Realtors and motivated Home Buyers.

We will get through this. Homes will sell again (maybe a little differently), but as with other past disasters, we will work with what we have. We are fortunate that this pandemic didn’t happen in the 1980’s! No internet or other digital resources would have brought the real estate market to a dead stand still. With creative ways to communicate and share information online, it really is just a transition to newer ways of listing and selling real estate!

Sun Pacific Mortgage is deeply grateful to all the devoted first- responders and dedicated doctors and nurses who put their lives on the line everyday for us. We haven’t forgotten the brave grocery store workers and others who have kept our tables full during these stressful times. You are all our heroes. Stay safe and stay strong!

We continue to provide our alternative financing services for real estate needs. Don’t hesitate to see what we can help you and/or a client with by visiting our website at www.Sunpacificmortgage.com