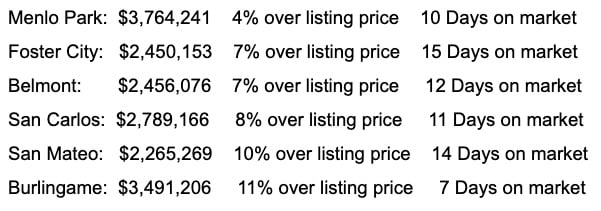

Despite the fear mongers’ warnings, life and real estate go on as before in San Francisco and the Peninsula when we are speaking of the real estate market. While there is no longer the frenetic pace of the past two years, buyers and sellers continue to engage in transactions with hefty profits. We have only to examine the past quarter of San Francisco sales to see that, while there has been a very slight slow down in business, homes are still selling above asking price for single-family residences.

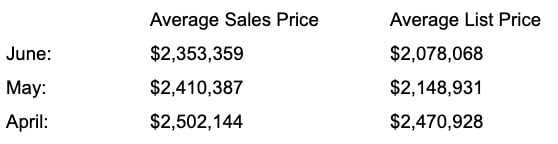

The Peninsula is also showing no backsliding when it comes to average sales vs. listing prices:

The Peninsula is also showing no backsliding when it comes to average sales vs. listing prices:

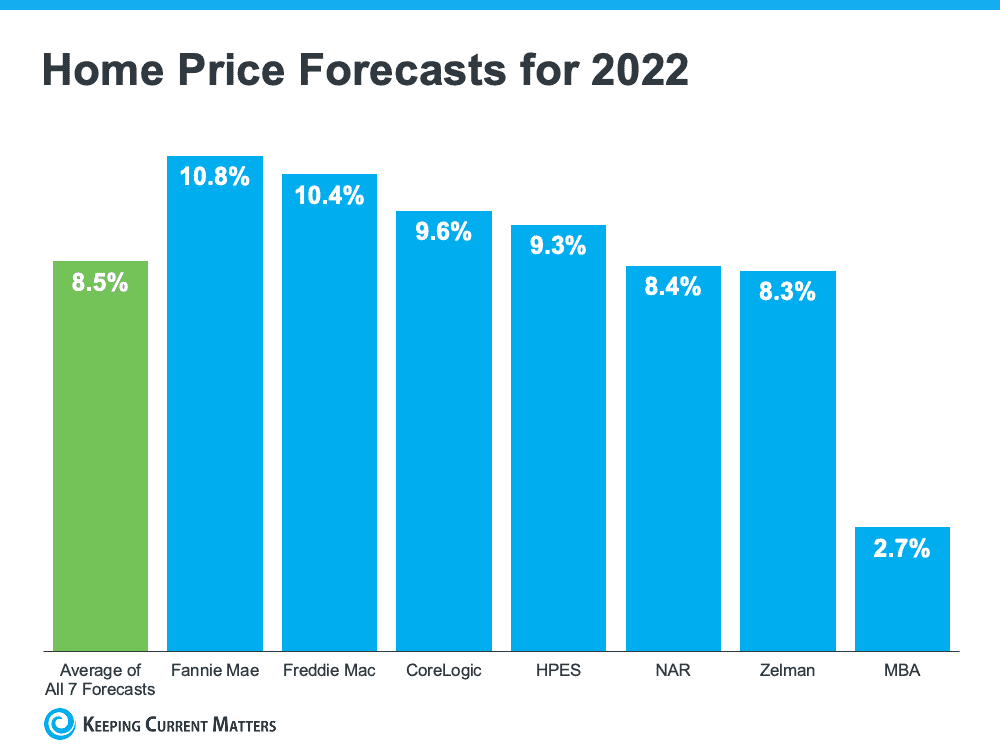

With the year half over and the economy in flux, it is difficult to predict the future, but most economists are still recommending real estate as a safe investment vehicle to increase personal wealth.

With the year half over and the economy in flux, it is difficult to predict the future, but most economists are still recommending real estate as a safe investment vehicle to increase personal wealth.

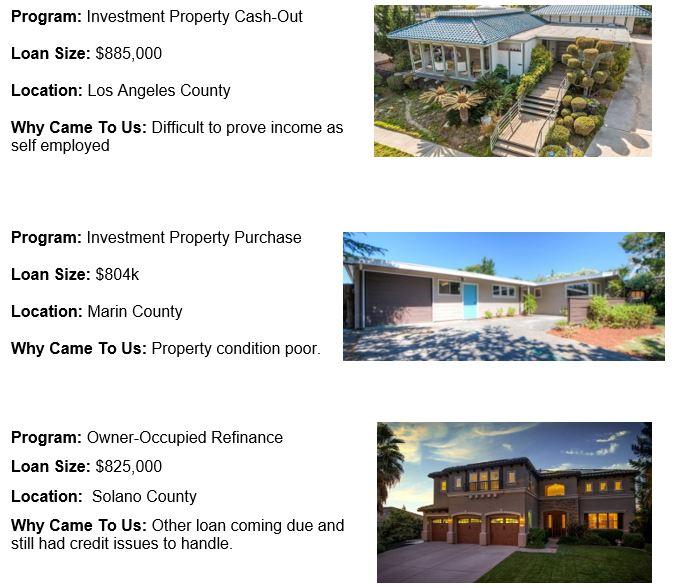

If you need help finding a mortgage for California real estate because you have not qualified for a conventional loan, give Sun Pacific Mortgage a call at 707-523-2099 or visit our website at www.sunpacificmortgage.com.