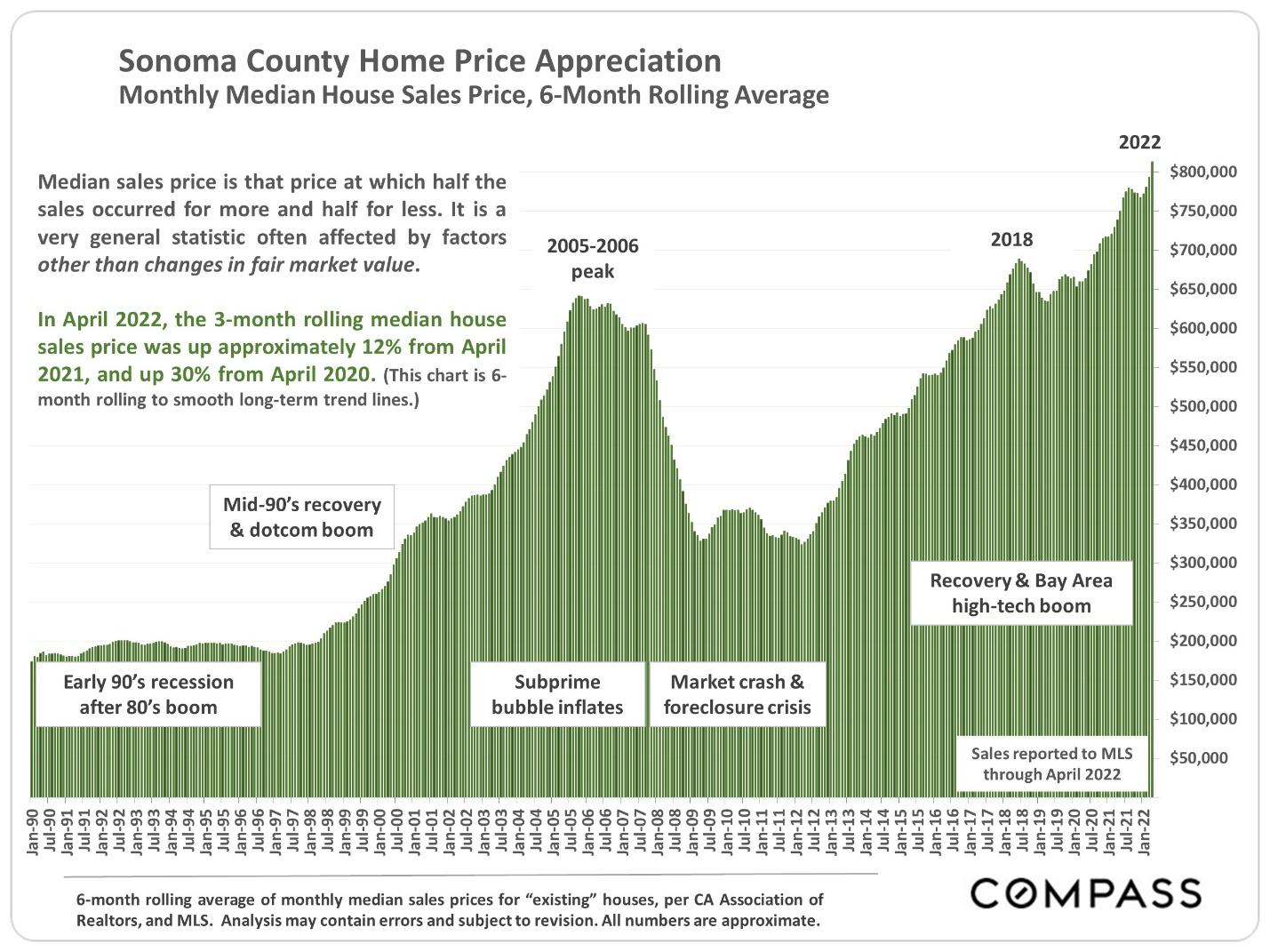

One of the hottest topics in the world of real estate today is the shortage of available homes. There are just too many Buyers and not enough Sellers. This means good news for Sellers, not so much for Buyers. But as life begins to return to normal, that may begin to change.

One of the hottest topics in the world of real estate today is the shortage of available homes. There are just too many Buyers and not enough Sellers. This means good news for Sellers, not so much for Buyers. But as life begins to return to normal, that may begin to change.

If we look for the root cause(s) of this shortage, we find the factors that contributed to this problem and what the future might hold as a remedy.

Where did the shortage come from? Don’t blame the rush of Buyers wanting more “home office friendly” dwellings. This low supply was a product of the lack of new homes built over the past decades.

Historically, builders completed an average of 1.5 million new housing units per year. However, the building gap in the U.S. totaled more than 5.5 million in the last 20 years. To correct this shortfall, new construction would need to accelerate to more than 2 million housing units per year, according to The National Association of Realtors.

When we look at existing homes, the latest reports indicate a positive housing supply growing gradually month-over-month showing that things are beginning to shift. Some experts are optimistic enough to say that we may have turned the corner.

Here in California, it is still a great time to sell. Growing companies, families wanting more house and space for joint work-live situations, Californians who moved away starting to move back, these are all reasons real estate remains strong and more homes are being built!

If you are hesitant to put your home on the market because you fear you will not find a replacement, consider a Bridge Loan from Sun Pacific Mortgage. Accessing your present home’s equity, you would be poised to present a very strong offer on your new property. This very popular private money loan would allow you a quick close with a cash offer, something every Seller is looking for at this time.

Give us a call at 707-523-2099 or email us through our website at www.sunpacificmortgage.com to see what we can do for you to ease the tension of selling and buying in these competitive times.