We’ve realized that our hometown – Santa Rosa, Sonoma County, CA – has taught us a BIG lesson: No matter what happens, be it wildfires or Coronavirus, we will be open and help all we can! Sonoma Strong!

With the volatility in the stock market and uncertainty about the Coronavirus some are concerned we may be headed for another housing crash like the one we experienced from 2006-2008. The mere scare of this coronavirus and the mystery of its effects are producing hysteria.

There are many indications this real estate market is nothing like the 2006/2008 market but instead is staying strong!

Our Alt-A Hard Money program is super popular, realtors & financial institutions are busy with potential home buyers knowing now is the time to buy and many homeowners are refinancing with the 30-year conventional rates at historic lows.

With the multiple counties operating on “shelter-in” mandates, it is more important than ever to ensure clients who are in need of our alternative refinancing get it. We therefore will continue to provide our services while putting in extra actions to ensure the safety and health of family members at our company.

Timely news recently promoted this in a local paper by licensed Real Estate Agent, Eli Tucker:

“Currently, buyers still seem more motivated by historically low rates and lack of buying opportunities than they are concerned that they likely impact of the virus. It seems that long-term confidence in local real estate is still a stronger influence on people’s decisions”.

Here are some facts showing the current market is stronger:

1. Mortgage standards are nothing like they were back then.

During the housing bubble, it was not difficult to get a mortgage. Today, it is tough to qualify. Not everyone can get a loan

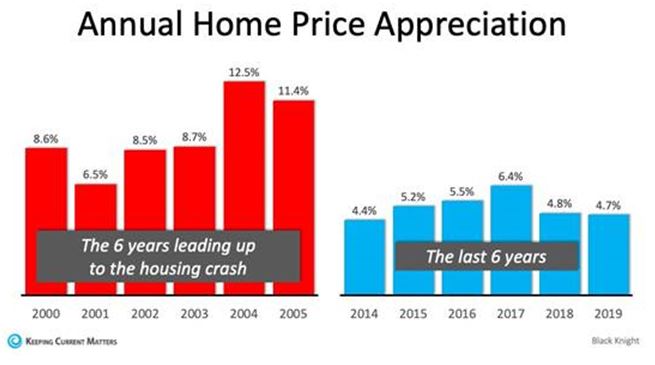

2. Prices are not soaring out of control.

Below is a graph showing annual house appreciation over the past six years, compared to the six years leading up to the height of the housing bubble. Though price appreciation has been quite strong recently, it is nowhere near the rise in prices that preceded the crash.

3. We don’t have a surplus of homes on the market. We have a shortage.

The months’ supply of inventory needed to sustain a normal real estate market is approximately six months. Anything more than that is an overabundance and will causes prices to depreciate. Anything less than that is a shortage and will lead to continued appreciation. Statistically there were too many homes for sale in 2007, and that contributed to prices tumbling. Today, there’s a shortage of inventory which is causing an appreciation in home values.

4. People are equity rich, not tapped out.

In the run-up to the housing bubble, homeowners were using their homes as a personal ATM machine. Many immediately withdrew their equity once it built up, and they learned their lesson in the process. Prices have risen nicely over the last few years, leading to over fifty percent of homes in the country having greater than 50% equity. But owners have not been tapping into it like the last time. Compared to 2005 – 2007, homeowners have cashed out over $500 billion dollars less than before.

We have also spoken to many individuals in the California lending and real estate fields as well as experienced opinion leaders in the medical field. Below are facts & information from credible sources we hope helps to bring stability and calm:

From long-time licensed realtor, D.M.: “It’s important to keep things in perspective. It may take some time but the market will power through & become stronger as a result.”

From licensed Realtor and Lender of 32+ years, Owner: “We made it through the fires and came out stronger, together. Working together our community will get through this too.”

And from a friend of one of our family members, who is a microbiologist closely involved in the research side of both medical and weaponized microbiology:

“Unfortunately, the first things I need to address is the plethora of misinformation being circulated, which has recently grown out of control. It is easy to cherry-pick statistics to fit any narrative, even from reputable sources.

“Coronavirus is a common viral family in both humans and animals. Stop spreading fear and start being more critical of your information sources and how data might be manipulated. Even in the medical field, very few are trained extensively in virology. If you have an underlying medical condition, make sure you are properly managing it to decrease the odds of complications. Keep healthy and informed friends!”

Bottom line:

Real Estate market is still strong. We are in business and doing well, buyers are still out shopping, homeowners are still refinancing to pull cash out for their businesses and personal use.

We all need to flourish & prosper as best we can so that our community is helped and gets back to normal.