Sun Pacific Investor Welcome

A Newsletter for Investors who work with us.

Integrity • Knowledge • Honesty

Hello,

With increased business, it is imperative to be more efficient. We thought it beneficial to lay out in detail exactly what to expect when you invest in Deeds of Trusts through us.

We are a family owned & operated company and have been doing Hard Money Loans since 1988. We are located in Santa Rosa, California (north of San Francisco in the Sonoma County wine country) and offer available NOTES to invest in throughout all of California, continuing a legacy of over 3 decades in the Private Money lending business.

WHAT WE DO

WHAT WE DO:

- We are licensed Hard Money Brokers. We do not service loans, we don’t have a pool, we don’t have a Trust Account, we don’t have an Escrow company – we promote for real estate loans and place these with Investors. Yes, been doing this since 1988.

- Once we get in a loan – direct from a Borrower, from another Mortgage Broker, Real Estate Agent or Lender, etc. – we work to gather a complete loan submission file for our Investors. This includes: a complete loan application, credit report, Preliminary Title report, value of property, borrower’s income, reserves and more. We have a stringent process when reviewing loans that come to us, so Investors see only about 60% of what comes across our desks.

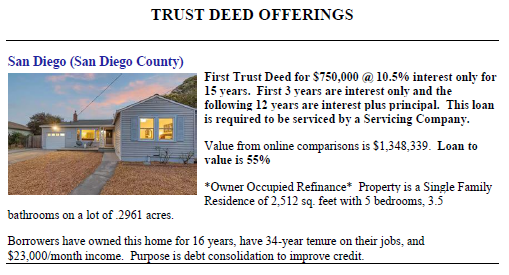

- Once we have a complete loan submission with a cleared Title, we publish a Trust Deed Offering via email (see an example below). Each Offering includes property address, loan to value, proposed interest rate, picture of the property, bit of information about borrower and property. If interested, the Investor replies to this email, and we send the full loan submission package to them so they can make an informed decision (this is similar to a dropbox or icloud link).

Again, we want to note that we do a fair amount of vetting on each loan that comes to us. Only 2 out of about 10 that come to us for a loan, meet our qualifications before it even goes out to you as the Investor.

- We prefer “One Loan, One Investor” (we do not have a pool of money from Investors sitting in a Trust account). However, when this is not possible (due to size of loan, etc.) we are open to our Investors fractionalizing or co-investing in a loan (meaning several investors each put in a fraction of the loan amount until the total is met – and they each get the interest return on their individual investment). If there is a Single Investor who decides they will singly fund the loan, they will get priority over a fractionalized lenders.

- Did you know that you need to be qualified to invest money in Hard Money Loans? This is a Federal Rule, enforced by the State of California. You CANNOT invest more than 10% of your net worth! And… net worth does not include your home, furnishings or automobiles. Give us a call to help determine what your net worth is.

- Once the loan is approved by an Investor or Investors, WE prepare Hard Money Loan Documents for the borrower(s) to sign. These are specific documents from a HARD MONEY LOAN DOCUMENT PROGRAM that we use. These loan documents are sent to Escrow with a copy of the Promissory Note and Deed of Trust, while a copy is sent to you for your review. At this time, we give you an estimate of when the loan will need funding (with instructions on when and where to wire your money to Escrow – as we don’t touch your money).

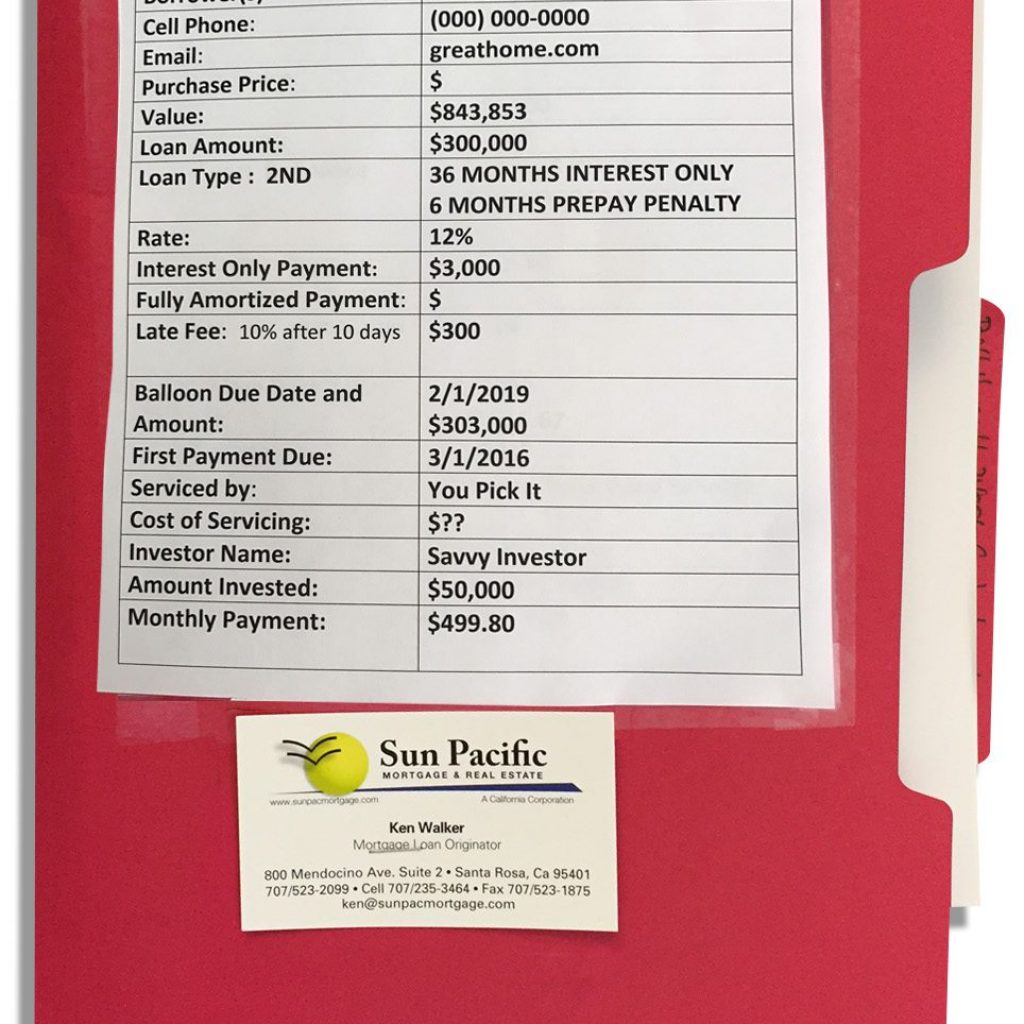

- Once the Hard Money Loan Documents are signed in Escrow, you have funded the loan, and it is now officially “closed”, within a week’s time you will receive all copies of the signed documents via email if you want or, you can be mailed our famous “INVESTOR RED FILE”. Included in it is a copy of all signed loan documents. On the front of the file is a simple summary: Name of Borrower, Address of Property, Loan Amount, Interest Rate. Here’s a picture of a Famous Investor Red File!

Note: You will receive your pro-rated interest with this file. You will receive any reimbursement of wire fees directly from Escrow, as this is a cost the borrower covers.

- Average time from start to finish for us is 16 days – but many do fund within a single week or less.

- For servicing of the loan, you are responsible for connecting up with the Servicer and ensuring all their forms are completed by you to properly set up the loan for complete servicing.

WHAT YOU DO

- After you sign up to be an Investor with us (meaning you’ve filled out the State required Investor Questionnaire form and given us your email address) we will send you a “Welcome Investor” email. Please read this in full, as it comes with some additional information about investing and the booklet from State of California about investing in Hard Money.

- We will add you to our secure and private Investor database to start sending you our offerings. We send out available Deeds of Trusts about 2 times a day, as we get new ones – around 10:00am and again around 2:00pm. We try to be consistent for the sake of our Investors and enabling them to check for available Offerings and not miss out. See below example of an Offering.

- When you see an Offering that you are interested in – and have money available to place on that Trust Deed – all you need to do is reply to the email. Let us know which property you are interested in and we will send you the loan package or link to all the loan documents that we have collected – so you can do your due diligence to determine if it’s a good investment for you or not. NOTE: You are not approving the loan when you say you are interested and want the package! Feel free to ask any other questions you have at this time. Your email response goes directly to the Broker and Lead Loan Originator.

- You will always receive a response within 24 hours max – even if the loan is no longer available. If you do not hear from us within 24 hours, please call us or send in another email. Also check your spam for any response from us. We have a policy that every email or phone call gets responded to as quickly as possible. On a very busy day that may be as long as 24 hours, but never more than that.

- Once you receive the loan submission, you should review it and exercise any other due diligence until you are comfortable with that loan or wish to decline it.

- Once you approve the loan, you will fill out and sign an “Investor Approval” form, which includes your Vesting and your choice of Servicing Company – if you chose to use one, which we do advise. We are unable to prepare our loan documents without this approval form, so please be efficient in sending it back to us.

- Get your funds ready so they can be wired to Escrow in a timely fashion. Our Processing Department will be in contact with you, giving specific instructions about when and where to wire funds, etc. Once requested, send your funds to Escrow as per instructions. NOTE: Do call our office or email back if any uncertainty or to clarify anything needed.

- At this point, we will email or mail you our “Famous Investor Red File” (which was shown above). This is sent within 1 week of closing the loan and send to you by Priority Mail.

- And then the process begins again!