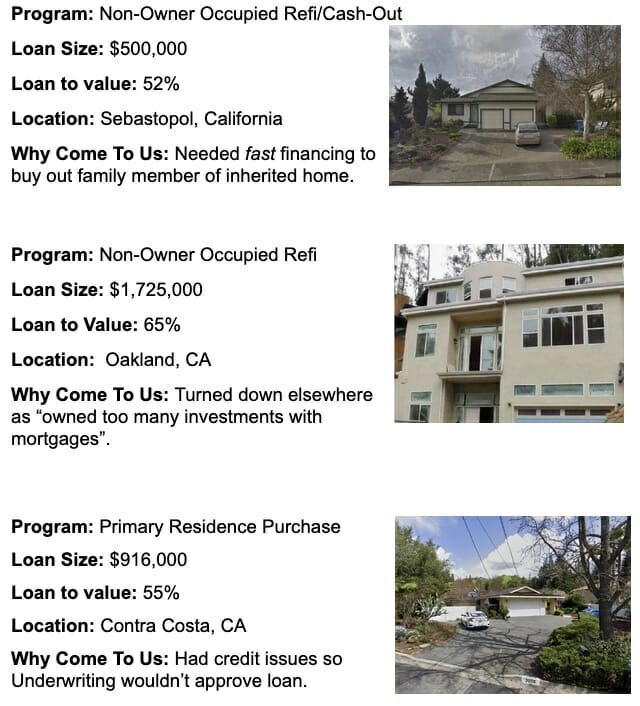

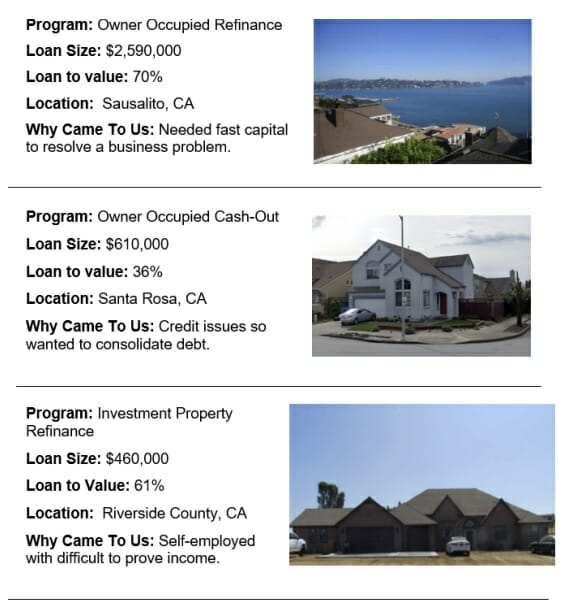

With the Real Estate boom we have experienced over the past couple of years, there is an increasing demand for real estate investments financing. One type of financing for investment properties may come from a private lender, and just like with a traditional lender, the Borrower agrees on a set interest rate and timeframe that they will pay the loan back. With Private Lenders, rates are generally higher and the loan period is shorter. These loans are secured by the property’s equity and if the Borrower fails to make payments on time, just as with a traditional loan, the property can be foreclosed on, and the Lender takes possession.

In most cases, a Private Money Lender will focus more on the value of the property and its potential for returns, rather than the Borrower’s income and/or net worth.

Here are some aspects of borrowing Private Money, also known as Hard Money:

- Hard Money loans are meant to be short-term, temporary financing. This may be necessary because the Borrower needs a fast close, has difficulty proving income, or has a less than desirable FICO score.

- The interest rates vary depending on several factors: Loan To Value primarily then a bit relating to property condition, location, or risk.

- Percentage points (fees to access funding) will vary but they are never up-front costs. These are how the Broker is paid.

- Additional fees include: Escrow costs, appraisals, wire fees and other miscellaneous administrative fees.

When you are in need of a real estate loan, the following information will be required of you:

- The Loan Application, also known as a 1003

- Any signed Purchase Agreement or Copy of Mortgage statement

- Property Insurance Quote/Insurer’s information

- Something showing income (bank statement, W2, tax return, CPA letter, etc.)

Sun Pacific Mortgage has been in the business of Private Money lending for 33+ years in California and has the expertise, plus knowledge needed to make your Borrowing experience less stressful. Give us a call at 707-523-2099 or visit our loan programs page to see what we can do for you.