For purposes of this report, we are including the counties of Marin, Mendocino, Napa, Solano, and Sonoma.

For purposes of this report, we are including the counties of Marin, Mendocino, Napa, Solano, and Sonoma.

Inventory at end of June: 2,429 homes and condos (30% over last year; 19% over last month)

Nationally, listings are up 31% over the past year.

There were 1,310 sales in June, which was 30% below last year’s total sales and 12% below last month’s sales.

The ratio of listings whose price was lowered for each county reads as follows: Sonoma 16%, Mendocino 22%, Napa 23%.

Those counties whose sales were more than the original listing price were as follows: Mendocino 26%, Napa 45%, Sonoma 61%.

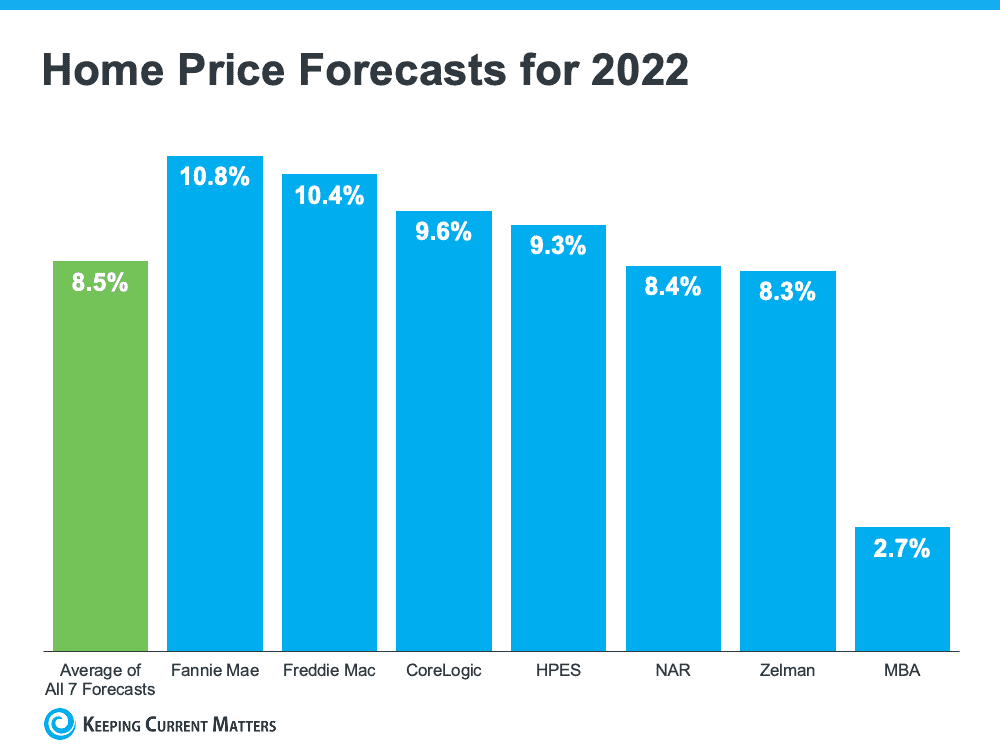

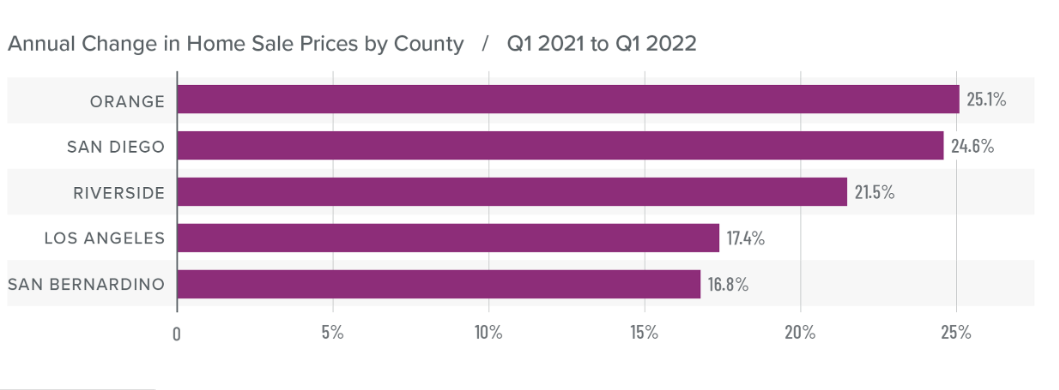

Average sales price = $955,270 (+8% YTY)

Median Days on Market = 31 (-26% YTY)

Sales vs. List price = 102% (0% YTY)

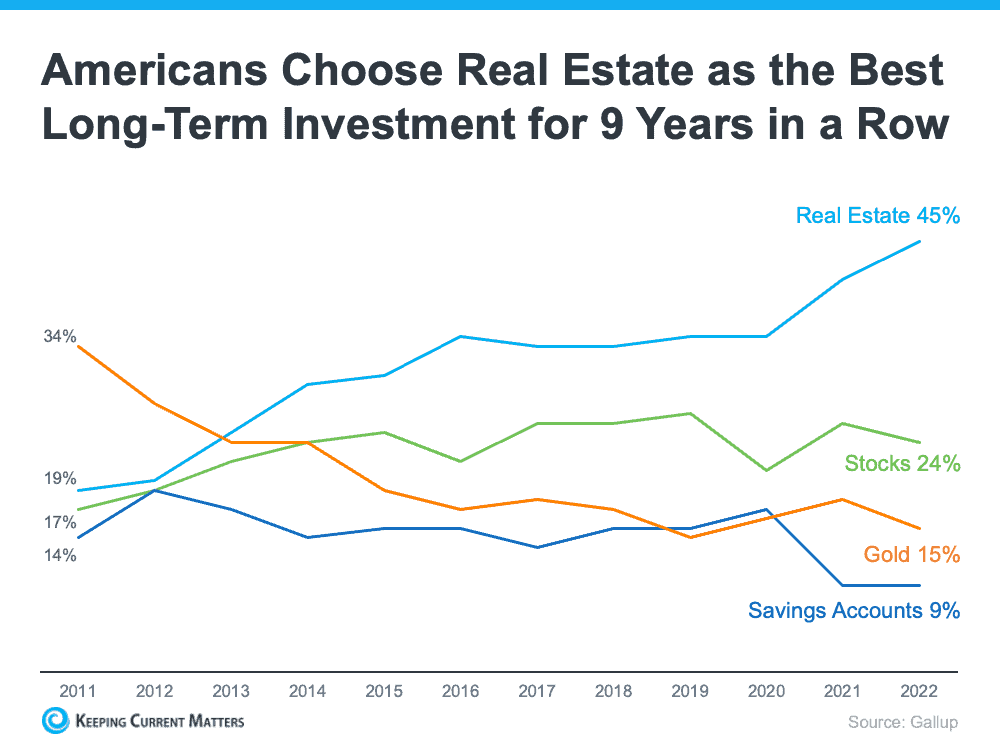

What conclusions are we to take from this report? We are not in a free-fall, but real estate has cooled slightly off the frenetic pace we were on for the past couple of years. We are certainly not looking at another 2008, and for good reason. There is plenty of equity in existing homes and inventory is just not plentiful enough to satisfy the demand.

If you need help with your mortgage search, give Sun Pacific Mortgage a call at 707-523-2099 or visit our website at www.sunpacificmortgage.com. We do fast, private loans considering loan-to-value rather than credit scores.