Life happens, and with it sometimes it has less than desirable consequences. An example of a negative impact on our lives is a bad credit report. This damaging report isn’t always a sign of irresponsible choices but can just as easily be the result of an unexpected and disastrous health or financial occurrence.

Unfortunately, FICO scores don’t take into account extraneous circumstances that may have led to the disruption of your good credit. A Hard Money loan, also known as a Private Money loan, can be the lifeboat that offers a temporary “work-around” until such reports can be remedied.

With a poor credit or bad credit score, banks and other lending institutions might deem you too high a risk and decline your loan application. Additionally, conventional lenders will disqualify an unoccupied commercial space, fixer-uppers, and residential properties, both owner occupied and rentals because they don’t meet the federal requirements.

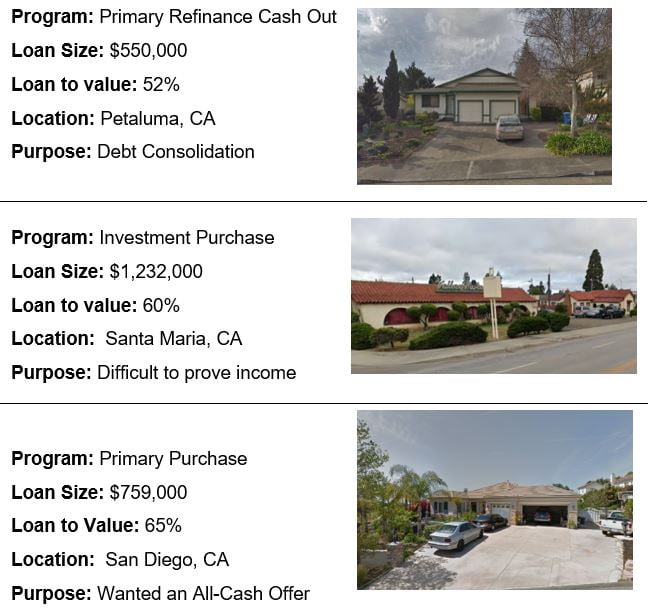

If you find a great real estate opportunity but can’t qualify for a conventional loan, our investors are here to help. Helping Borrowers and Investors is what Sun Pacific Mortgage has done for the past 33 years for the California real estate community. We match up Borrower and Investor to maximize the financial rewards for both.

Give us a call at 707-523-2099 if you need a fast, Private Money loan or you are an Investor looking to maximize your returns, through Trust Deed investments.

We are well aware of the low inventory and high prices which have prevailed in the real estate market for over a year. This has intimidated many buyers recently and kept them from attempting to get into the bidding wars. As a buyer, what is the best approach when making an offer today that will help make your offer a stand-out?

We are well aware of the low inventory and high prices which have prevailed in the real estate market for over a year. This has intimidated many buyers recently and kept them from attempting to get into the bidding wars. As a buyer, what is the best approach when making an offer today that will help make your offer a stand-out?