A summary of the real estate market in California might read, “mixed bag”. While home prices increased year-over-year in July, the number of homes sold fell by a whopping 31.1% and the number of homes for sale rose as compared to last year. According to the California Association of Realtors 30 counties recorded sales declined more than 30% from last year.

The Central Coast experienced the largest decline among major regions, with sales decreasing 37.3% from the previous year. However, the good news for sellers is, median sales price continued to grow in nearly 80% of the California counties! The final median home prices decreased by only 3.5% to $833,910 (meaning homes are selling for less than asking price) – but this median home price was 2.8% higher than last year at this time.

The report for August reads as follows:

- Closed sales per day: 513

- Pending sales per day: 306

- New listings per day: 260

- % Of active listings with reduced price: 41.6%

- % Of homes closed above list price: 35%

- Median days of the market for closed sales: 22

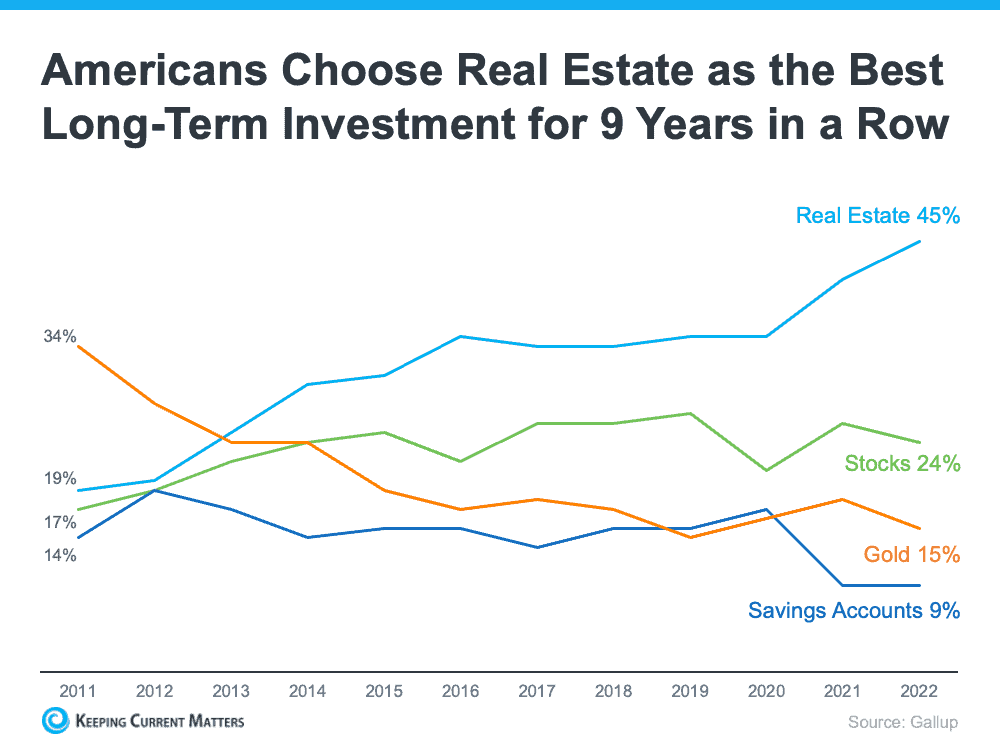

Currently, we see some markets cooling down. It is good to keep in mind that all real estate is local and the national news headlines don’t necessarily apply to every market around the country. It would appear that in most of California it has gone from an extreme seller’s market to a more balanced one. One thing remains constant: real estate is now and always has been a sound investment.

If you are looking for a profitable place to invest your portfolio, give Sun Pacific Mortgage a call at 707-523-2099 or visit our website at www.sunpacificmortgage.com and become one of our many private investors in Deeds of Trusts. Earn upwards of 13% return on your investments in stronger real estate Notes.