For a variety of reasons, thousands of California Homeowners are adding Accessory Dwelling Units to their property. Whether it is for housing adult kids, aging parents, or another source of income, these smaller homes can be built for a fraction of the cost of a new house and can be installed relatively quickly.

For a variety of reasons, thousands of California Homeowners are adding Accessory Dwelling Units to their property. Whether it is for housing adult kids, aging parents, or another source of income, these smaller homes can be built for a fraction of the cost of a new house and can be installed relatively quickly.

These units are viewed as part of the solution to California’s housing crisis and as a result we have seen laws passed over the last five years which have made it considerably easier to obtain permits while slashing local fees. Nevertheless, these projects are expensive, the rules can be complex, and the bureaucratic hurdles can be daunting.

ADUs can be attached or detached. They can be new builds or a conversion of an existing structure. According to a survey of ADU owners in Berkeley, the median construction price in 2020 was $150,000 or about $250 per square foot. Construction prices had risen dramatically since 2020, so the cost will be considerably more in today’s economy.

In support of these constructions, the law states that local governments retain some authority to set objective standards for such things as height limits, setbacks, parking requirements and landscaping, but if the ADU is no more than 800 square feet and16 feet high, set back at least 4 feet from the property line, it is eligible for a permit in any residential or mixed-use zone.

Local officials must act on a completed ADU application within 60 days or else it is automatically approved. At least that is what the law requires. A developer in Campbell who specializes in ADUs says that there is still “a ton of boxes to check” to get the project approved.

An ADU is still a complicated, costly project no matter how small it is because it requires a kitchen, a bathroom, a sewer connection and permits. As a builder in Los Angeles stated, “The stuff that you don’t see is the most important stuff-the foundation, the plumbing the electrical, what’s hidden behind the walls.”

The other key point to consider in a decision to add an ADU to your property is the increase in your property tax bill. Newly constructed ADUs are assessed at market value upon completion, which in California with a 1.25% tax rate, could raise your property tax on an ADU valued at $200,000 by $2,500 a year.

The idea of an ADU is a bit more glamorous than the reality when examining all the aspects associated with the build. But, for many Homeowners it had been the answer to otherwise unsurmountable problems. Weighing the pros and cons before embarking on a project this large, and consulting with local officials and contractors is essential to a successful outcome.

If you have been denied a loan from your bank or other lending institution, consider a privately funded loan from the investors at Sun Pacific Mortgage. Call us today at 707-523-2099 or visit our website at www.sunpacificmortgage.com to see how we can help you with your real estate financing needs.

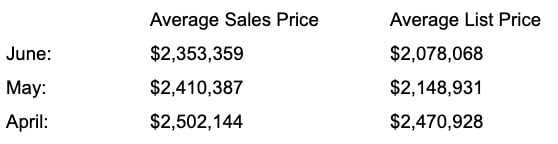

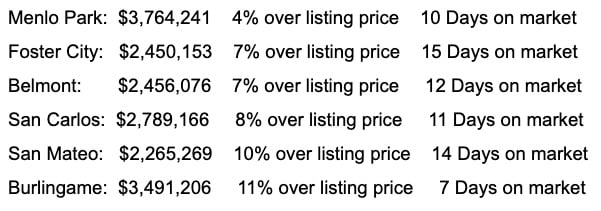

The Peninsula is also showing no backsliding when it comes to average sales vs. listing prices:

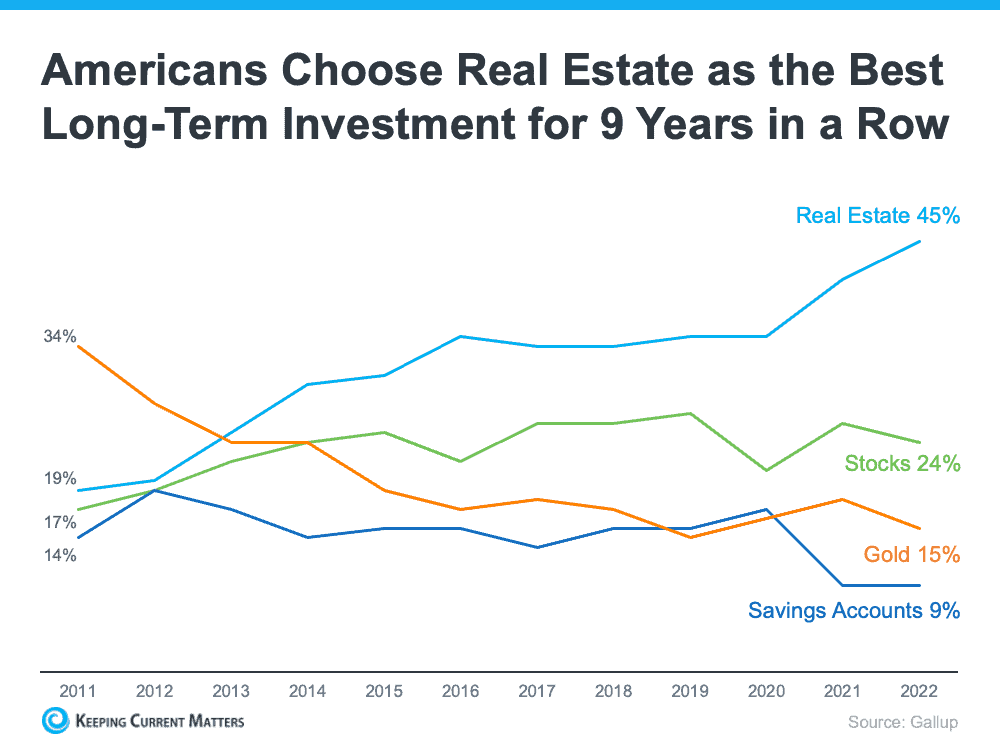

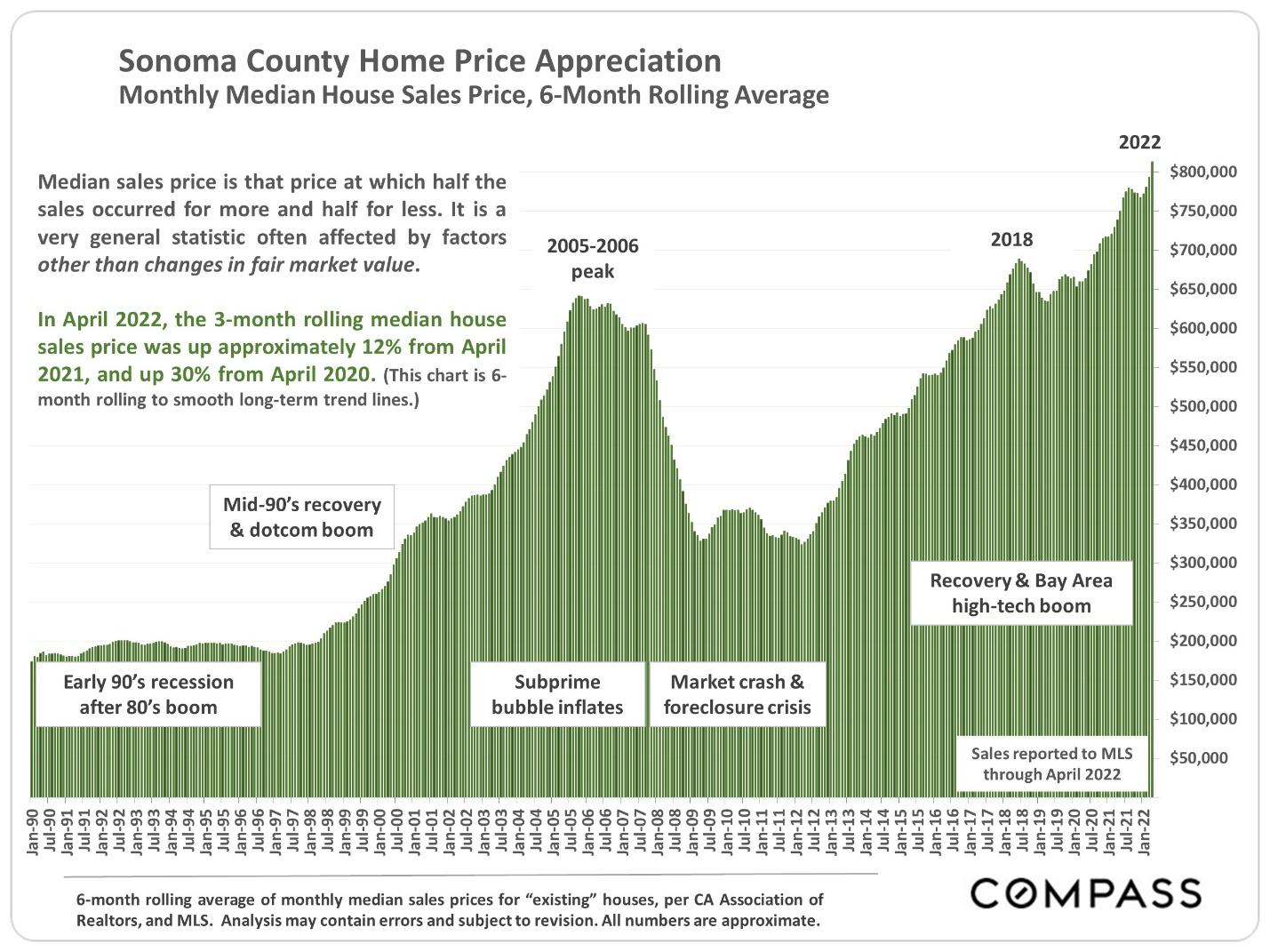

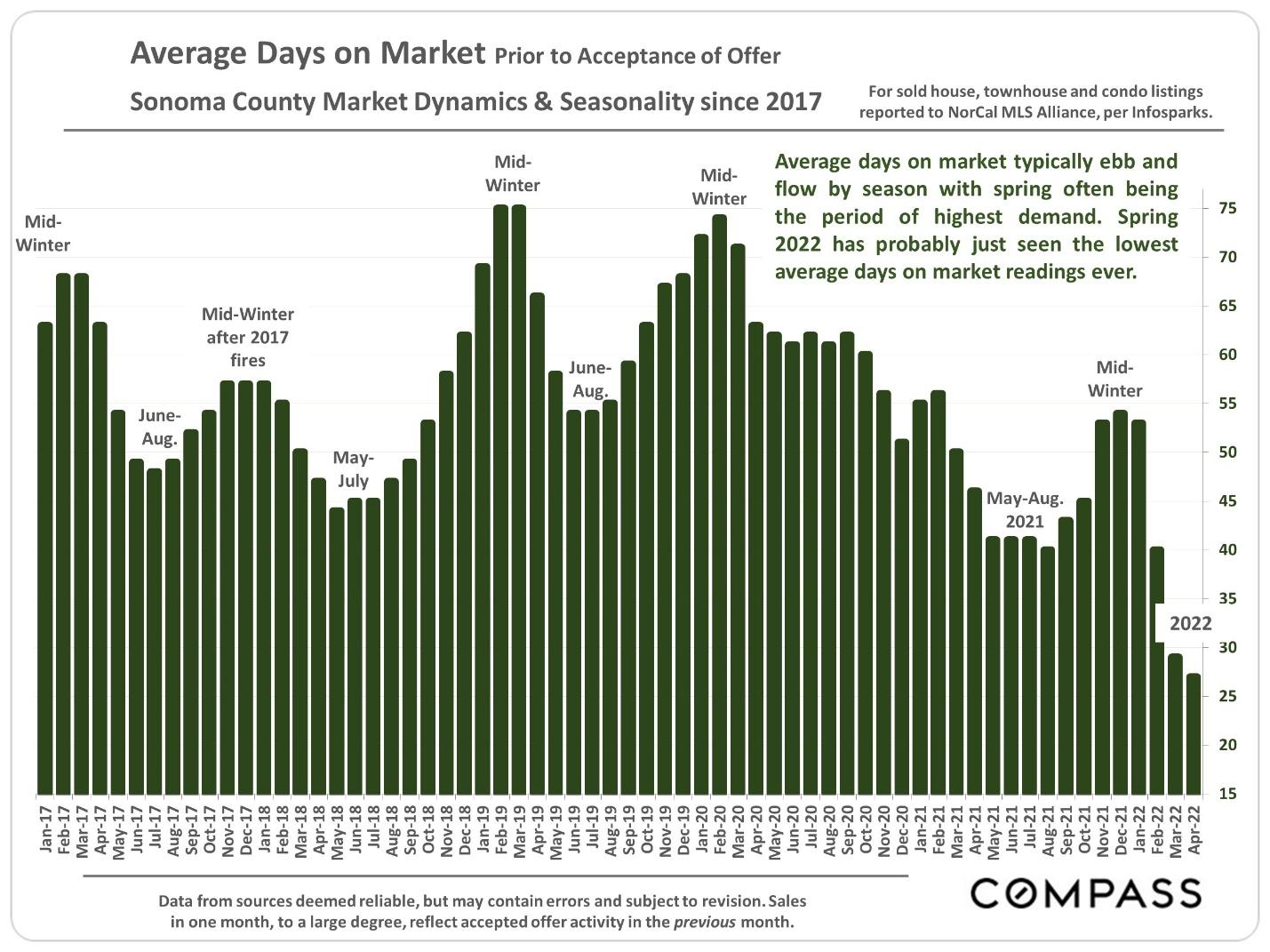

The Peninsula is also showing no backsliding when it comes to average sales vs. listing prices: With the year half over and the economy in flux, it is difficult to predict the future, but most economists are still recommending real estate as a safe investment vehicle to increase personal wealth.

With the year half over and the economy in flux, it is difficult to predict the future, but most economists are still recommending real estate as a safe investment vehicle to increase personal wealth.