Another stellar month for San Francisco real estate in October. Despite all the naysayers’ predictions that the market was on its way down, all markers indicate a continued upward trend. Here are the results for last month’s single-family residence in San Francisco:

- Average List Price: $2,093,971

- Average Sales Price: $2,358,448 ($2,131,959 in Sept.)

- Average Sq. Ft. Price: $1,093.37

- Average D.O.M: 19

- All Sold Properties: 709 (575 in Sept.)

- SFR Sold: 303

- 36 below price

- 11 for listing price

- 256 above listing price

- One SFR sold for $1,506,248 OVER listing price

With the holidays approaching, we usually don’t expect many homes coming up for sale, but since it appears that we are constantly in new territory when it comes to the real estate market lately, we could see a significant reversal of the norm.

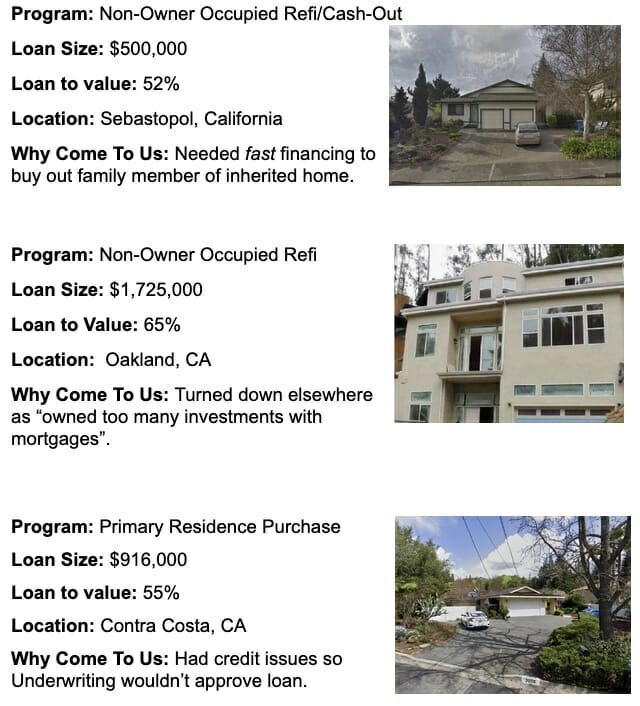

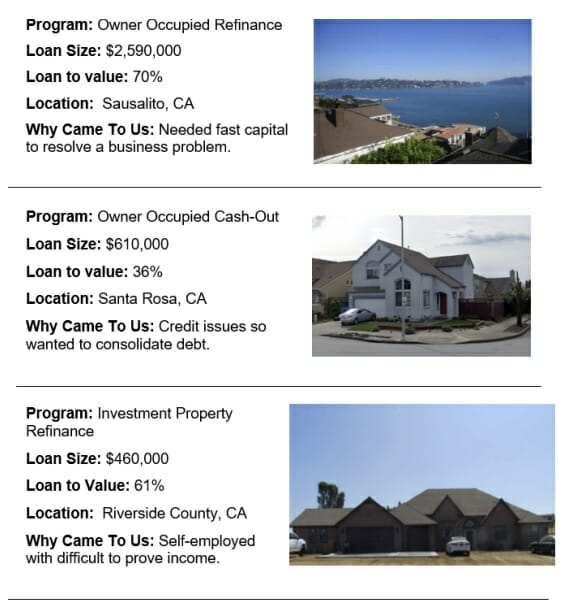

If you are looking to sell/buy anywhere in California, give Sun Pacific Mortgage a call at 707-523-2099 to discuss the many lending programs we offer for purchasing, refinancing, and bridging on owner-occupied and investment properties. Or visit our website www.sunpacificmortgage.com to learn more!

Fast Financing that will Leaf you Breathless!

Fast Financing that will Leaf you Breathless! Give us a call today to see how we can help with fast financing (707) 523-2099. Or visit our website at

Give us a call today to see how we can help with fast financing (707) 523-2099. Or visit our website at