Get Financing From Family Company – Ranked One of the Top 500

Despite current circumstances, we have successfully continued to lend to individuals who are in need of a home loan – to get fast cash-out from equity, to do repairs, money to buy a home, do debt consolidation, pay off balloon payments due, etc.

Our desire to assist those who need fast financing or have just missed qualifying for traditional “A-Paper” home loans, has prompted us to work closely with our myriad of investors and get a strong mortgage program that can be of help!

This unique “Alt-A Hard Money” program has benefited quite a few borrowers in need over these past few months, offering lower-than usual Hard Money rates:

– Borrowers with good credit (640+)

– Lower Loan To Value (55% LTV or lower)

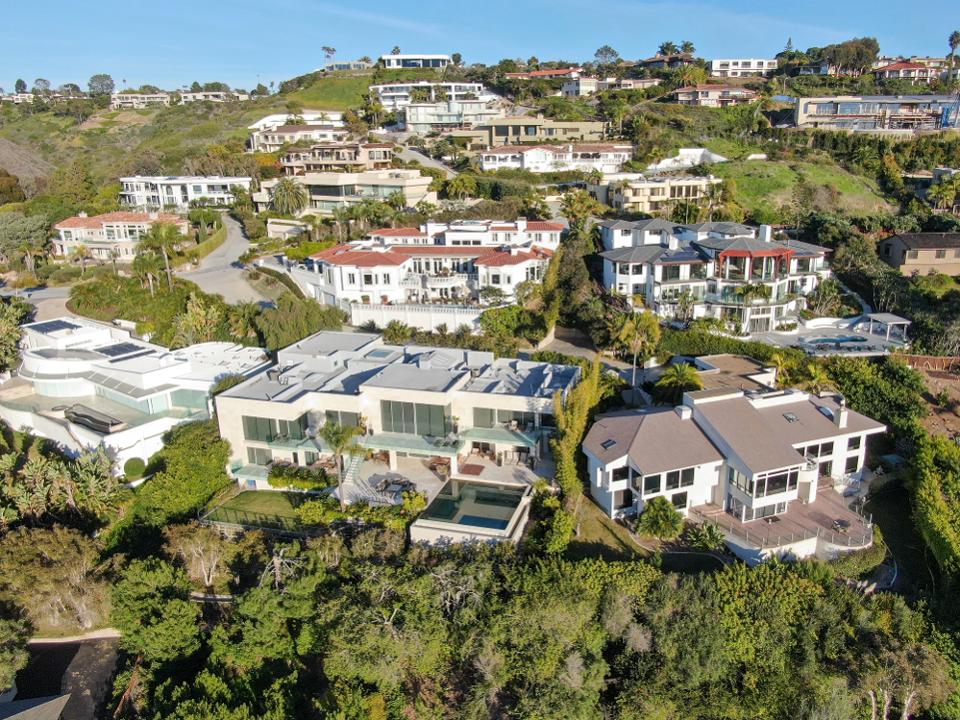

– Nice property in good location

We are known for providing fast financing and our specialty has become this new “Alt-A Hard Money” program. In business for more than three decades, we remain family owned & operated and have helped thousands of individuals with their real estate financial needs throughout California.

Email back or Call Us at 707-523-2099 if you would like to see if you qualify for this unique mortgage program. We’ll let you know quickly if we can be of help.

Best, Broker & Broker – The Guys in the White Hats