A survey was conducted in the fourth quarter of 2020 of real estate professionals to determine the biggest stumbling blocks to growth in 2021.The following are some of the key trends they see as potential difficulties:

- Inventory shortages: With levels down 22% from the previous year, this was the main concern of 84% of those surveyed.

- Widely distributed vaccines to boost consumer confidence: Even with the availability of the vaccine, the market could remain highly competitive given the starting point of the market going into 2021. Good for sellers, not so much for buyers.

- Low mortgage rates: Renters are speeding up their home buying, and older adults are deciding to downsize sooner. This will add to the buyers and sellers for 2021.

- A permanent move to remote work: This factor was especially a weighted issue in California where the trend has been felt already in 2020. The professionals see this as a continuing trend in 2021.

- Affordability challenges persist: Finding down payments has been one of the biggest obstacles to homeownership. This challenge will persist into 2021, although some experts are optimistic that expected tax credits may help.

Despite this mixed bag of good news/bad news, the experts remain largely confident that the real estate market for 2021 looks as promising as last year’s surprising outcome.

And for those who live in California or are considering to move to one of the beautiful coastal counties of California such as Monterey, Santa Barbara or San Diego, If you are looking for help in funding your real estate investment this year but are finding stumbling blocks when applying with conventional lenders, give Sun Pacific Mortgage a call at 707-523-2099. We have helped thousands of borrowers just like you over the past 33 years to find private investors who are eager to invest in you and your dreams.

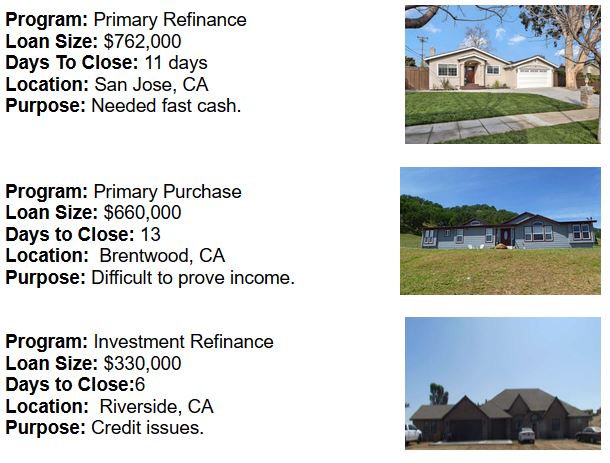

$1,725,000 loan

$1,725,000 loan

Primary Residence Refinance

Primary Residence Refinance