We attended the California Mortgage Association quarterly conference in Newport Beach from last Wednesday through Friday. The Keynote Speaker was noted economist Christopher Thornberg from Beacon Economics. On the current market place he states… “This isn’t optimism, there is simply nothing out there at the moment, whether it’s the sell off in the stock market or rising interest rates, that has the power or speed to knock the expansion off its track; and apart from a rapidly growing Federal budget deficit, the U.S. economy looks fairly well-balanced in terms of the fundamentals.” He further states that this includes “…private sector debt levels, consumer savings rates, rising wages, the overall pace of homebuilding and business investment. Unemployment is low- but job growth remains steady.”

There are times at the office when we spot circumstances in the market place that manifest to us in our office statistics. When we have a lot of promotional actions going on but the results are a complete change from what they would at other times bring about, we look for the “why”.

Thornberg hits the nail on the head with his term for what is occurring in spite of nothing but good financial news. Miserablism. That certainly rang true to me. There is absolutely nothing wrong with the market that can’t be solved with the real news getting out that there – there is nothing but good news on most fronts. I blame the press, but it does no real good. What I can do, and we all should do, is spread the news that it is a good time to buy, it’s a great time to sell. it’s a good time to borrow. Fund that kids college fund. Do those home improvements. Fund your retirement fund and then pay it off. Buy a rental property. Buy your dream home. Get a boat, a motor home. Go on a dream vacation.

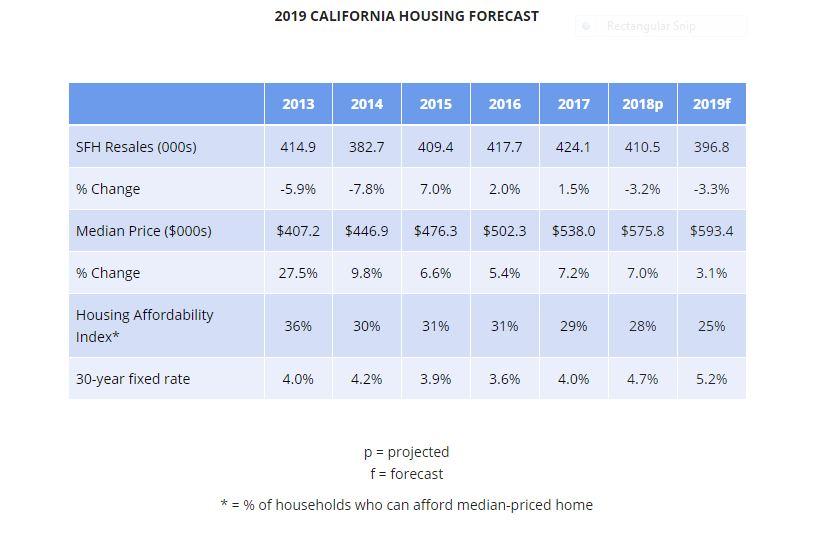

I have a suggestion. Stop listening to the press. Instead promote the actual statistics. They tell the true tale of what is going on.

On a more individual level, I am going to do all my prior successful actions without fail. I’m going to get out more marketing. I’m going to ask for big loans. I’m going to ask for referrals. I’m going to be quicker with responses.

Above all, I am going to have and promote a positive attitude knowing that this is the best economic times I personally have been involved with in my 31 years of doing home loans. I’ll bet that’s true for you too.

So spread the good news that there is nothing but good news. It will have the desired effect which is just to get people doing what they would actually be doing if they weren’t miserable!

By the way, send me any Hard Money scenarios you may have and I’ll get you a quick proposal.