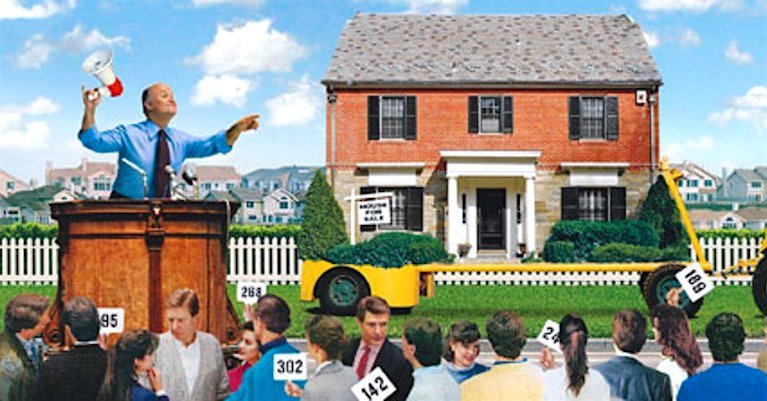

In an excellent article written by Erica Sweeney for Realtor.com, the author lists common myths that she wishes to debunk. We feel that this article is so on-point with California mortgage market, that we want to share the essence with you.

Recent days have brought on changes unheard of in the past, especially in the mortgage business. Experts have shared their truths regarding what is really happening, and these facts are presented here with their opposing myths being debunked:

- Everyone qualifies for a low interest loan: This is only true for borrowers with good credit scores (a minimum of 620) or higher. It also depends on the size of your down payment, condition of the property and other factors.

- Getting a mortgage today is easy: Because of the pandemic and unemployment jitters, lenders have tightened their loan requirements. Some financial institutions are not even considering jumbo loans (max of $510,400). Other Mortgage Brokers are asking for 20% down and a minimum credit score of 700. As if this were not discouraging enough, the anticipation of lower interest rates has generated a glut of applications waiting to be reviewed, so if you’re in a hurry, you could potentially miss your window of opportunity.

- Everyone should refinance their mortgage: This makes sense if you plan to stay in your current house for a long period of time. Otherwise, for those Californian’s who are looking to move out of expensive real estate cities such as San Francisco, San Mateo, Marin, etc. should just consider the 2%-6% origination fees it takes to acquire a new mortgage so you work out additional savings or realize the cost for the refinance.

- You can apply for a mortgage after you’ve found a home: This is a very real mistake borrowers make. In these riskier and surprisingly faster paced days of house-hunting in Sonoma County, San Francisco County and in fact the entire Bay Area, sellers want to make sure you are not just a “looky-loo”. They will know you are serious if you are pre-approved and, as a buyer, you will know exactly how much financing you can expect – so get pre-qualified before you waste time or effort.

- Mortgage forbearance means you don’t have to pay back your loan: Nearly 8% of mortgages (3.8 million homeowners) were in forbearance as of July 26 according to the Mortgage Bankers Association. It is wise to understand that forbearance is not forgiveness. It is more of a “time-out” with no negative impact to your credit score and no late fees. Borrowers will still need to reach an agreement about these missed payments with their lender, and agreements usually entail adding these payments to the back end of the loan, not forgiving them.

If, after reading this information, you realize that you need help getting that real estate financing you need or want, consider calling Sun Pacific Mortgage. We have been in business over 32 years in California, offering our alternative financing – also known as hard money loans – for home owners & home buyers just like you. We are not restricted by the stringent regulations for these low-cost loans. Our office has been able to help many Realtors and other Mortgage Brokers and their clients, who fall short of qualifying for a conventional loan of any type. Give us a call at 707-523-2099 to see what we can do for you. We can perform fast, with many financed in under 1-2 weeks.