Whether to invest in real estate or stocks is a personal choice that depends on your financial situation, risk tolerance, goals, and investment style.

When you buy stocks, you buy a tiny piece of that company. In general, you can make money two ways with stocks: value appreciation as the company’s stock increases and dividends.

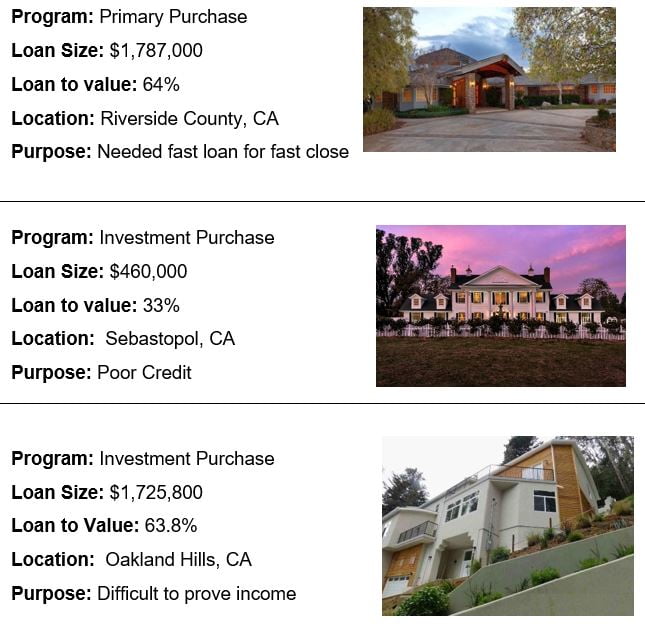

When you buy real estate, you acquire physical land or property. Most real estate investors make money by collecting rent or mortgage payments, as is the case with private investors at Sun Pacific Mortgage. These private investors are provided a steady income stream and through appreciation, as the property value goes up, a hedge against a bad borrower.

For many prospective investors, real estate is appealing because it is a tangible asset that can be controlled, with the added benefit of diversification.

Comparing the returns of real estate and the stock market is an apples-to-oranges comparison because the factors that affect prices, values, and returns are very distinct. But, bottom line, both present risks and rewards. Smart investors opt for a variety of asset classes to reduce their risk.

Investing in real estate is an ideal way to diversify your investment portfolio, reduce risks, and maximize returns. If you like the idea of investing in real estate, but don’t want to own and manage properties, become a private investor with Sun Pacific Mortgage. We have hundreds of private investors who choose to fund our trust deeds and maximize their investments with returns up to 13%.

Call Sun Pacific Mortgage at 523-2099 or check us out at www.sunpacmortgage.com and discover a better way to increase your family’s wealth.