Lately, we have been bombarded with the doom-and-gloom messages about the “inevitable” Recession at our doorstep. As professionals, we have the obligation to inform and educate our clients about the financial climate, and this means giving them the “real scoop” as it affects their investments.

Steve Harney, a spokesman for Keeping Current Matters, delivered a podcast recently on this very subject, and offered some valuable insights into the approach recommended for realtors and brokers. Safe click link to recent “Will A Recession Affect The Housing Market” webinar and graphs & statistics about real estate markets in past recessions:

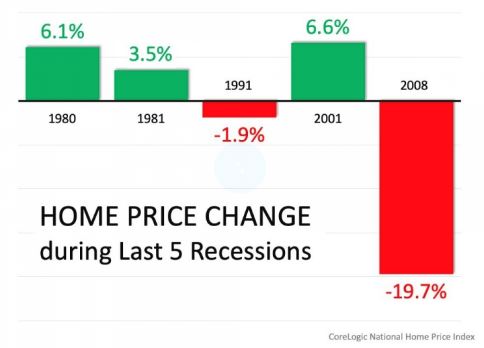

Steve pointed out that we have enjoyed the longest run of economic recovery in our history, but as it has been with history trend, all good things must come to an end. The definition of “recession” is two consecutive quarters where the GPA decreases. Given this definition 42% of consumers think a recession will happen in 18 months. Experts postulate that it will occur in the second half of 2019 or the first half of 2020. The most important fact to keep in mind is that a Recession does not mean a housing crisis.

Unlike the last Great Recession, mortgages have been strictly regulated and most homeowners are in a great place financially relative to their home ownership. In fact, it has been pointed out that smart people are buying up real estate now because it is much more stable than other markets. Wise investors see this period as a great opportunity to add to their real estate investments.

As professionals it is our obligation to clear up any confusion floating out there. It is well known that confusion equals paralysis, and that could spell disaster for the real estate economy. Aspiring home buyers hoping that home prices will crash are in for a rude awakening. The lack of housing and the demand for single-family homes by the giant millennium generation points to no drop-off in demand any time soon.

On the other hand, real estate professionals will likely meet up with worried potential sellers that may decide to postpone listing until they can get top dollar for their properties. Some experts believe the number of home sales will remain flat or possibly even dip. The priciest parts of the country, like California, could see price corrections, but sales might only decline 10%-20%. On the upside, if interest rates continue to fall, it could give the housing market a boost, since lower rates mean some buyers can afford a bigger house with a bigger mortgage.

So, the message at the end of it all: the news isn’t always factual. The Real Estate Market has held up throughout past recessions and its high time to let any and all current and potential home buyers and home sellers know that now is the time to buy and sell!