The North Bay cities of Santa Rosa, Petaluma, Rohnert Park, and Windsor showed marked declines in homes and condo sales numbers compared to June 2021, but smaller declines from May 2022. Here are some sample statistics:

The North Bay cities of Santa Rosa, Petaluma, Rohnert Park, and Windsor showed marked declines in homes and condo sales numbers compared to June 2021, but smaller declines from May 2022. Here are some sample statistics:

Santa Rosa:

- Available at end of June = 218 (-24% from June 2021; +28% from May 2022

- New sales = 184 (-36% from June 2021; -11% from May 2022)

- Median sales price = $750,000 (+6% from June 2021)

- Days on Market = 29

Petaluma:

- Available at end of June = 65 (+30% from June 2021; +30% from May 2022

- New sales = 62 (-8% from June 2021; = to May 2022)

- Median sales price = $947,000 (+6% from June 2021)

- Days on Market = 21

Rohnert Park:

- Available at end of June = 26 (-21% from June 2021; +1% from May 2022

- New sales = 37 (-26% from June 2021; -21% from May 2022)

- Median price = $733,000 (+32% from June 2021)

- Days on Market = 22

Windson:

- Available at end of June = 45 (+32% from June 2021; +55% from May 2022)

- New sales = 27 (-31% from June 2021; -23% from May 2022)

- Median price = $800,000

- Days on Market = 24

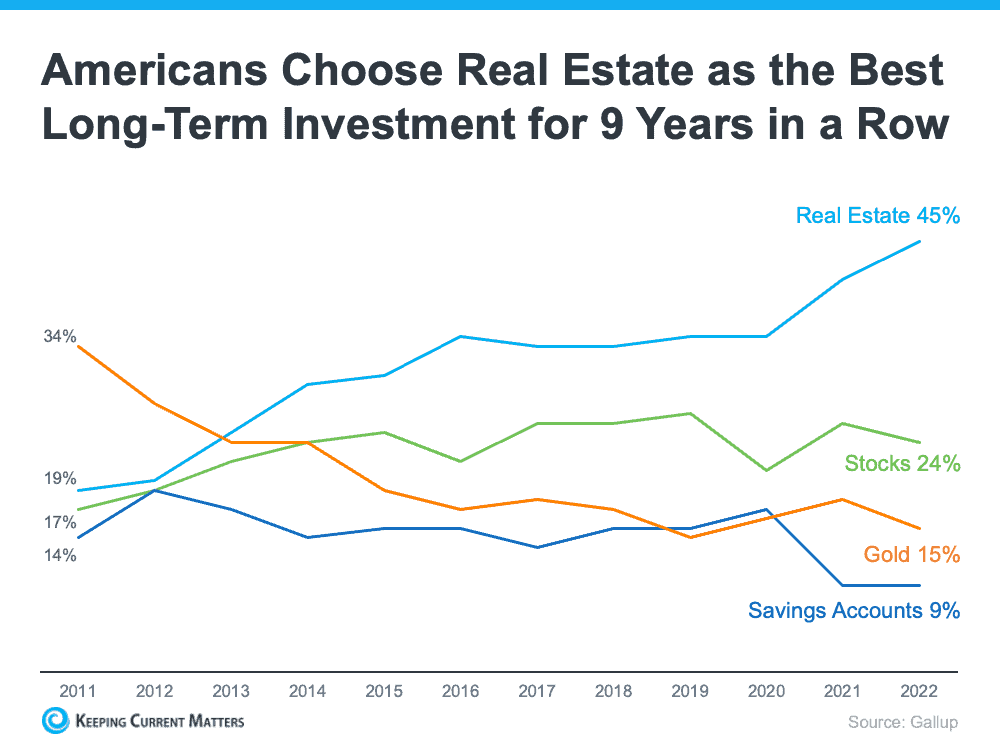

The rise in mortgage rates has triggered some slowdown in the market, but at this time most economist see this as a “housing correction” not a “housing bust.” They view the continued lack of available homes for sale to be the factor keeping prices from drastically falling currently.

If you are looking to buy in this ever-changing market, but cannot qualify for a conventional mortgage, give Sun Pacific Mortgage a call at 707-523-2099 or visit our website at www.sunpacificmortgage.com. We have been helping Borrowers like you in California for more than thirty-four years.