In an article that appeared in the local Sonoma County newspaper on October 14, 2022, Sara Edwards, their business reporter, had some interesting highlights to share regarding the real estate market today.

In an article that appeared in the local Sonoma County newspaper on October 14, 2022, Sara Edwards, their business reporter, had some interesting highlights to share regarding the real estate market today.

Some of her points included:

- Santa Rosa had the highest number of home sales in 2021

- Sebastopol was the most expensive

- 2,2440 homes sold in Santa Rosa in 2021=39% increase from 2019

- Sales in other local cities never surpassed 1000 homes

- More housing divisions that have been under construction are now getting completed in Santa Rosa

- Multiple buyers and offers, along with a lack of inventory contributed to increased sales prices.

- Sebastopol’s highest median sales price in 2021 was $1,095,000

- Sebastopol is the only city to have a median price over $1 million.

- Cotati and Rohnert Park were tied with the lowest median home sales price at $635,000

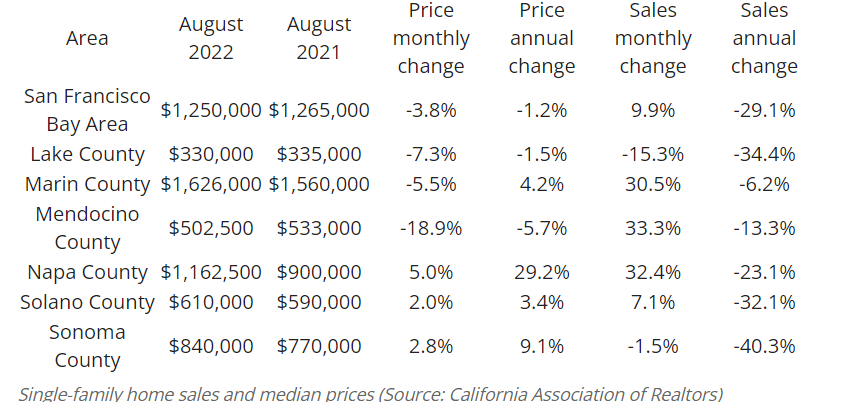

All of Sonoma County saw a frenzied housing market for the past two years, and while the market has somewhat cooled down, prices are not tanking. The multiple offers are few and far between but offers still come in above asking.

Knowing that homeownership is a great hedge against inflation, we can expect that California’s market will fair far better than other parts of the country.

If you are interested in becoming an investor or need to purchase or refinance, give Sun Pacific Mortgage a call at 707-523-2099 or find us at www.sunpacificmortgage.com. We offer fast, private loans for owner-occupied, non-owner occupied, commercial and land deals.