As professional investors you must be watching the financial news closely, ever in this ever-changing market. Well, so are we as lending professionals here at Sun Pacific Mortgage. There is a cadre of trusted and experienced economists and real estate authorities that have expressed their predictions and analyses regarding the state of the current real estate market. Some of the quotes I have come across in my research, I thought would be helpful in making your investment decisions:

Jeff Schween, Santa Rosa Fine Homes, Coldwell Banker

“Real estate markets are hyper-regional when it comes to market dynamics, which means one has to be cautious at putting much reliance on national news and fear mongers that make general statements about the marketplace. Sure, things are shifting all around and when they do it takes market participants a reasonable period of time to recalibrate their positions and the direction they take, but calamity is not in the data we are harvesting. We do believe that we will see interest rates climb further before they flatten out and whether or not they even return to the levels they are today is all the more reason to not let the cost of money be a deterrent.”

Lawrence Yun, Chief Economist, National Association of Realtors

In 2023, Yun foresees a slower price appreciation and corresponding increases in sales as the year progresses. “Next year, the annual median home price is expected to rise by only 1.2%. Home sales will pick up in the second half of 2023.”

Dollie Herman, Vice Chair of Douglas Elliman, one of the largest real estate firms in the US

“Obviously, everyone is experiencing a cooling of the market compared to 2021, but that is a bad comparison. Frankly, anything is going to sound horrible after last year, because that was not a normal year. You really have to look at the pre-pandemic numbers”

While acknowledging that rising interest rates are slowing down home sales, Herman noted that they are still well below the national historical average of 7.5%.

“I don’t see prices dropping significantly, and I think builders are holding back right now as well. I do think there will be more room for negotiation, especially as we get into the winter months, when things traditionally slow down.”

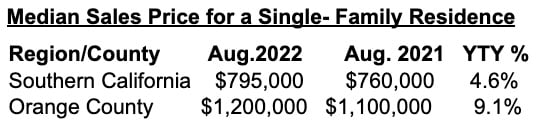

Real estate has been, and continues to be, one of the safest investments when considered as a long-term asset. Yes, it is slowing down, especially with the Holiday season upon us, but values though slightly decreasing are holding in a steady range.

It behooves one to keep abreast of what is truly happening and not listen to bad news. Also, being more conservative while continuing to invest in Deeds of Trusts by investing in lower LTVs and diversifying more.