Fast Mortgages to Fall Back on!

If you don’t qualify at this time for your home loan programs, having good Private Money loans to fall back on just might rescue your home purchase or refinance!

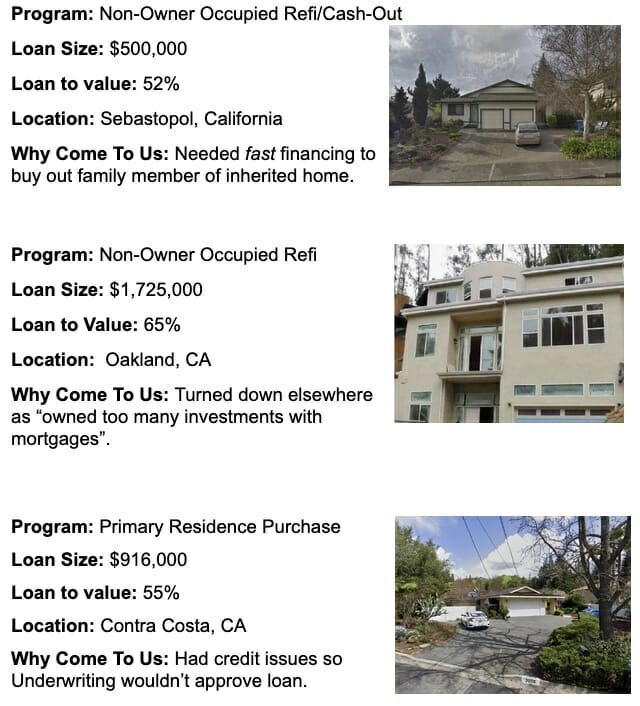

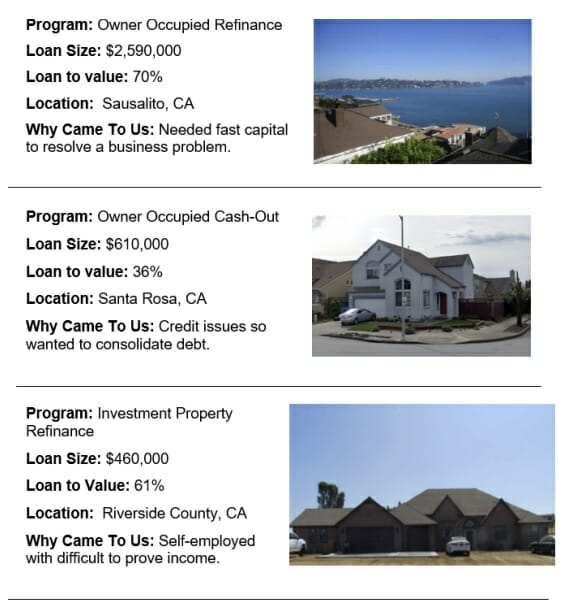

Give us the opportunity to help you, as we did below:

Home Loan of the Week

Loan program: Primary Residence Rush Refinance

Location: Sonoma County

Loan Size: $678,000

Reason Came To Us: Borrower was in Escrow, ready to close when the current Lender’s Underwriter declined the loan due to debt-to-income ratios. This Lender reached out, in hopes we could salvage the refinance, as this loan was needed to provide the down payment for another property they were in contract to purchase.

With some rapid action on our part, we got Investor approval and quickly funded within 5 days!

Give us a call at 707-523-2099 or email back with any questions or scenarios. We’ll quickly answer with what we can do to help you.