We’ve Wrangled You Up Our Hot Loan Program!

We’ve Wrangled You Up Our Hot Loan Program!

See our recent blog about how Private Money could help aid your next Investment:

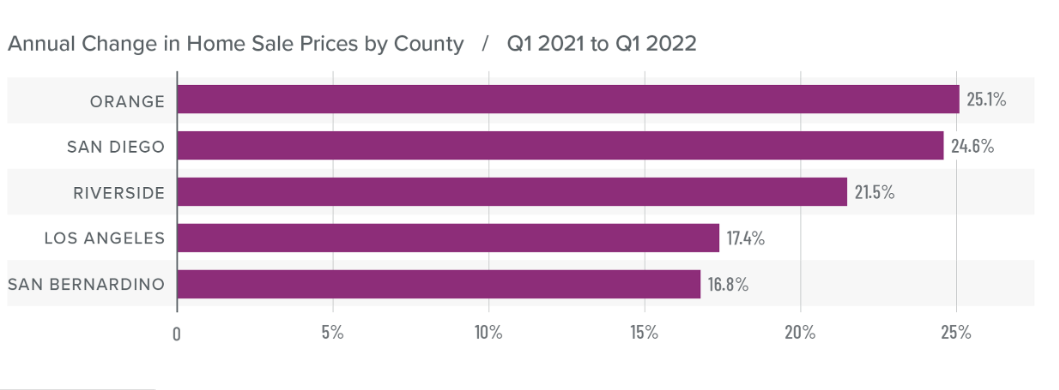

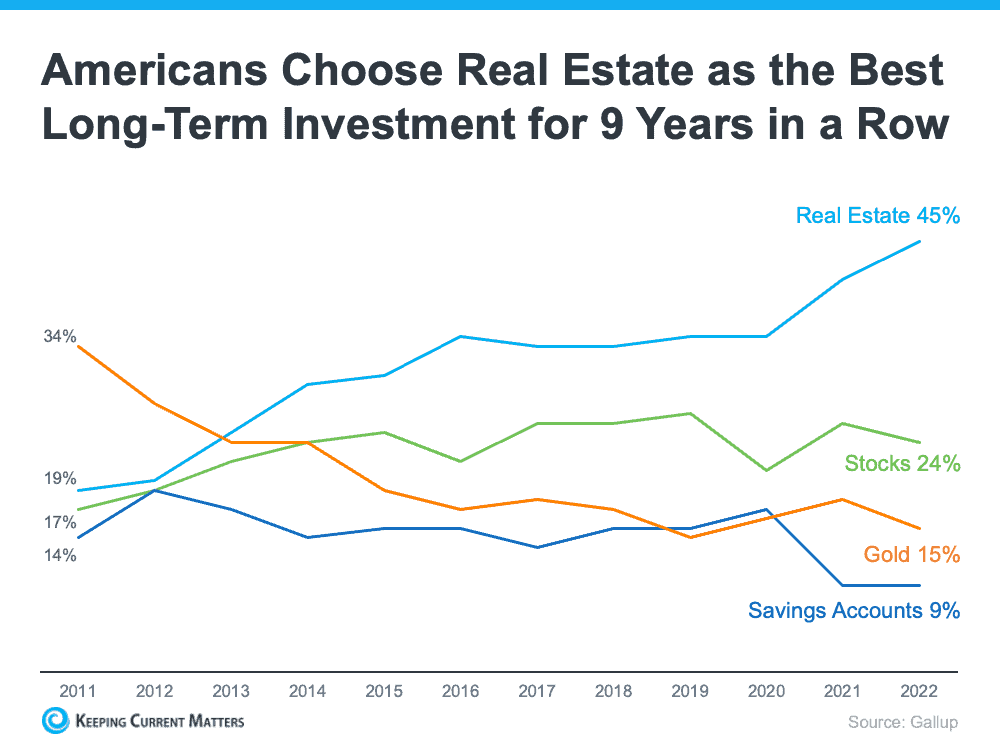

https://www.sunpacificmortgage.com/blogs/real-estate-voted-best-investment-eight-years-in-a-row/

Alt-A Hard Money By The Guys in the White Hats

Lower Hard money rates from 7% – 9% with this unique alternative finance program, for Borrowers and Buyers who are just shy of qualifying for conventional or traditional “A paper” loans:

- Good credit (640 and above)

- Below 60% Loan to Value

- Property in good condition and location

Perfect example of why this popular program is so beneficial:

Broker reached out to us for his Home Buyer, who needed a 799k short term loan to buy an investment property in Mill Valley. Underwriting was unable to provide final approval due to confusions about and LLC as the individual buying entity, despite great qualifications.

Buyer’s credit was over 750, he had a good down payment allowing for 56% LTV, he made great monthly income and had a lot of other real estate assets as well as excess funds in the bank. He was a perfect borrower – except he wanted to buy with his LLC – which is where we were able to wrangle up our unique Alt-A program and help!

If you have any question or scenarios for us, just call 707-523-2099 or visit our website at www.sunpacificmortgage.com. We will let you know how we can wrangle up the right private money loan program to help.