Not just the California real estate market but majority of the US market has surprised even the most knowledgeable experts in the field. Despite the crippling pandemic, unemployment crisis, a recession, and the looming presidential election, the residential real estate market is staging a surprising rebound.

According to realtor.com, the median home price increased by 6.2% over last year. Homes are selling faster than they did in 2019 and bidding wars are back!

To quote Ali Wolf, chief economist of Meyers Research, a national real estate consultancy:

“The housing recovery has been nothing less than remarkable. The expectation was that housing would be crushed. It was – for about two months-then it came roaring back. People are really quick today to compare today with the Great Recession, but we’re dealing with a different animal.”

The reason for this resurgence in home buying may well be because we are beginning to feel more confident about the idea of buying or selling a home. In fact, according to a survey conducted by Fannie Mae in June nearly 61% out of 1000 consumers said it was a good time to buy a home.

What’s driving this surprisingly hot market? One big reason is the severe shortage of homes for sale, making it great for sellers, not so much for buyers. This inequity leads to higher prices even during a recession and the worst public health crisis we have ever experienced. Add to that the historically low mortgage rates and you have another reason for the run on housing. In both Northern and Southern California the shortage started prior to the firestorms which occurred in 2017, 2018 & 2019.

But, why the rush to buy now? After spending several months at home, these potential buyers are asking, “If I’m going to spend the next 6-12 months working out of my house, I need a bigger house.”

Surprisingly, even with the worst unemployment since the Great Depression, many working Americans have held on to their jobs. These tend to be the higher-paid workers with the means to buy homes. Staying home more has meant more savings to boost their down payment reserves.

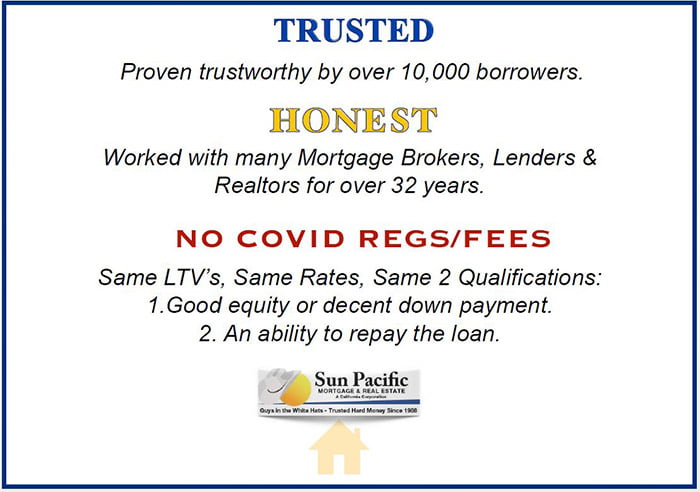

If you are in the “turned down elsewhere?” category for a conventional loan, but don’t want to be left out of this opportunity to move up or get into the market for the first time, give Sun Pacific Mortgage a call at 707-523-2099. We offer alternative financing, also known as Hard or Private Money. It has proven helpful to hundreds of our clients.